Posted On: July 18, 2023

Stock Report : UPL (NSE) 13 Jul 2023

UPL Limited, formerly United Phosphorus Limited, is an Indian multinational company that manufactures and markets agrochemicals, industrial chemicals, chemical intermediates, and specialty chemicals, and offers pesticides. Headquartered in Mumbai, Maharashtra, the company engages in both agro and non-agro activities.

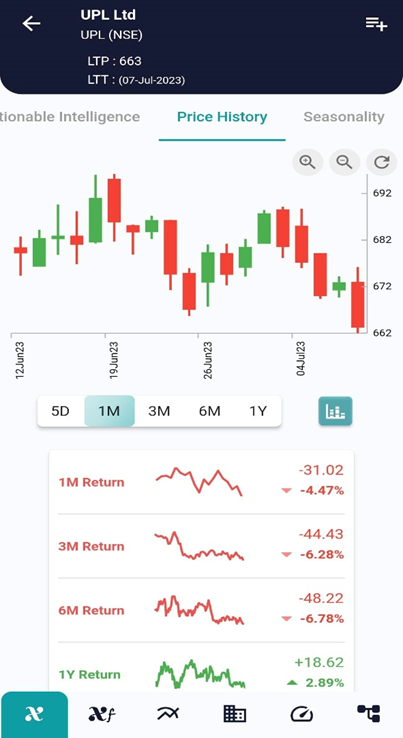

According to the analysis conducted by xCalData, it is predicted that UPL will continue its bearish phase over the next five days. During this period, the price trend of TI is expected to fall within the range of 649 to 679.

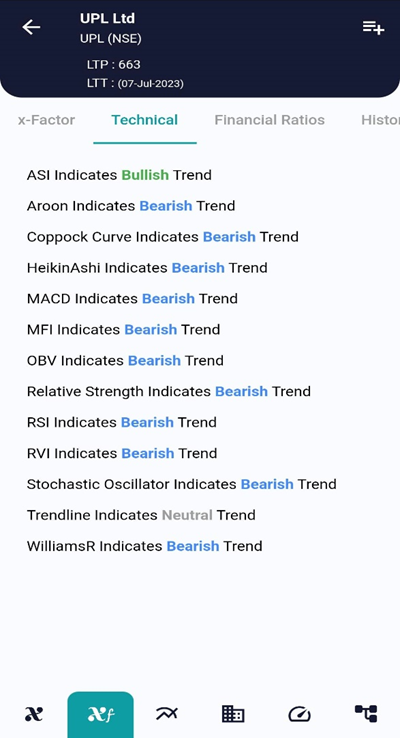

Based on the analysis of various technical ratios, the overall sentiment for the stock suggests a potential downward trend in its price. Most of the indicators lean towards the bearish side, indicating a negative outlook. Notably, the Money Flow Index (MFI) indicator shows a bearish signal, which suggests selling pressure and a possible decline in the stock’s price. However, the Accumulation Swing Index (ASI) indicates a bullish sentiment, implying that buying pressure may be present and could potentially drive the stock’s price higher.

UPL stock has double 1 time since 2015. It takes an average of 1.6 years to double.

In comparison to the previous month, the price of the stock has experienced a decline of 4.47%. This decrease indicates a negative movement in the stock’s price during that period. It’s important to note that a 4.47% decline over one month is a significant drop, and it suggests a bearish sentiment in the market.

#xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData.

Disclaimer: The securities quoted are for illustration only and are not recommendatory.