General

Posted On: November 1, 2023

Streamline Stock Scanning and Optimize Your Strategies with xCalData!

Introduction

In today’s fast-paced stock market, staying ahead of the curve is crucial for success. xCalData is here to simplify your stock scanning and strategy implementation, offering a wide range of tools and data-driven insights to help you make informed decisions. In this blog, we’ll explore how xCalData’s platform provides actionable intelligence, analyzes candlestick patterns, tracks moving averages, identifies gainers and losers, monitors sector trends, and detects trend reversals. Additionally, we’ll delve into strategies such as CAN SLIM, Darvas Box Method, and PL Classification, all designed to empower you in your trading and investment endeavors.

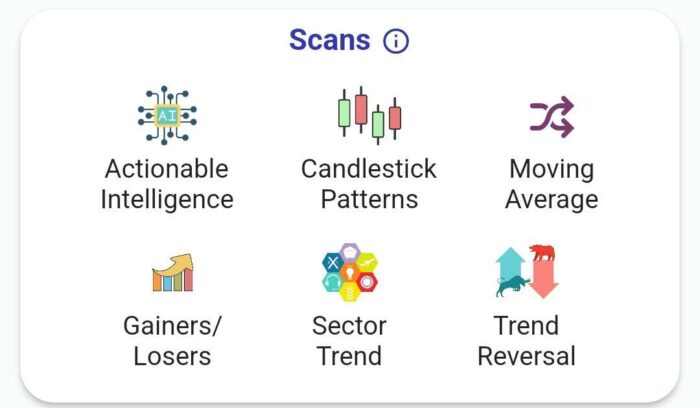

Powerful Stock Scans for Informed Decisions

xCalData’s stock scanning tools are designed to provide you with actionable intelligence to navigate the dynamic world of stock trading. Here’s what our platform offers:

- Actionable Intelligence: Our platform delivers real-time data and market insights, helping you stay informed about market trends, news, and developments that can impact your investment decisions.

- Candlestick Patterns: Access an extensive library of candlestick patterns to help you understand market sentiment and potential price movements.

- Moving Averages: Monitor moving averages to identify trends and make well-informed entry and exit decisions.

- Gainers and Losers: Stay on top of the market by tracking the day’s top gainers and losers, providing valuable insights into potential opportunities or risks.

- Sector Trends: Analyze sector trends to pinpoint industries with potential for growth or those experiencing a downturn.

- Trend Reversals: Detect trend reversals early on, allowing you to adapt your strategy to changing market conditions.

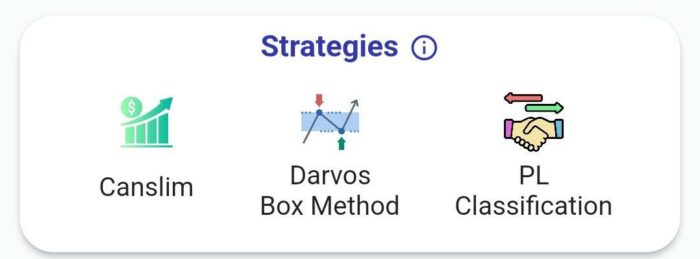

Implement Winning Strategies

xCalData goes beyond scanning tools and offers you a range of proven trading and investment strategies. Here are a few key strategies our platform supports:

- CAN SLIM: This strategy, developed by Investor’s Business Daily, focuses on finding stocks with strong fundamentals and technical. It includes components such as Current Earnings, Annual Earnings, and New Products or Services.

- Darvas Box Method: Named after legendary trader Nicolas Darvas, this method involves identifying and trading stocks within a defined price range or “box.”

- PL Classification: PL Classification is a classification method that helps you categorize and assess the investment potential of stocks based on various criteria.

Empowering Your Trading and Investment Journey

xCalData simplifies stock scanning and strategy implementation in several ways:

- Efficiency: Save time and effort with a one-stop platform that provides comprehensive tools and data-driven insights.

- Customization: Customize your scans and strategies to align with your unique trading or investment approach.

- Real-Time Data: Stay updated with real-time market data and insights, ensuring you make decisions based on the latest information.

- Risk Management: Make informed decisions by accessing the tools and information needed to manage risk effectively.

Conclusion

xCalData’s platform is your key to streamlining stock scanning and implementing winning trading and investment strategies. Whether you’re a seasoned trader or just beginning your investment journey, our comprehensive tools, actionable insights, and powerful strategies are designed to help you make informed decisions, manage risk effectively, and enhance your trading and investment success. Say goodbye to information overload and hello to data-driven, simplified trading and investment with xCalData. Start your journey with confidence today!

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight