Technical Indicator

Posted On: February 9, 2024

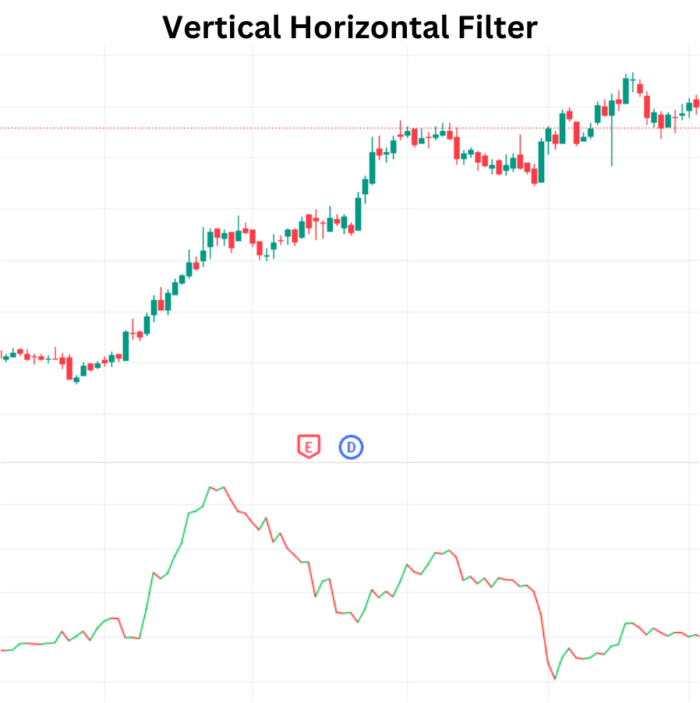

Strong Market Analysis with Vertical Horizontal Filter (VHF)

Introduction:

In the dynamic landscape of financial markets, distinguishing between trending and ranging conditions is paramount for traders. The Vertical Horizontal Filter (VHF) technical indicator , crafted by Adam White, stands as a beacon in this endeavor, designed to identify the ebb and flow of market trends. Much like the ADX in the Directional Movement System, the VHF serves as a compass, guiding traders to deploy trend or momentum indicators based on prevailing market conditions. Let’s delve into the strategies encapsulated in the VHF and how it empowers traders in navigating diverse market scenarios.

Formula for Vertical Horizontal Filter (VHF)

VHF=ABS(High Closing Price−Low Closing Price)/∑ n j=1ABS(Closej−Closej−1)

where,

VHF=Vertical Horizontal Filter

Identifying Trending and Ranging Markets:

The VHF excels in discerning between trending and ranging markets, providing traders with a valuable gauge of trend activity.

In trending markets, trend indicators come to the forefront, enabling traders to align their strategies with the prevailing trend. In ranging markets, momentum indicators take precedence.

Bullish Signal – Increasing VHF:

A pivotal aspect of the VHF strategy is the identification of bullish signals.

If the current day’s VHF value surpasses the previous day’s value, it signals a bullish trend, indicating an upward trajectory in market activity.

Bearish Signal – Decreasing VHF:

Conversely, the VHF strategy recognizes bearish signals by assessing decreases in VHF values.

When the current day’s VHF value falls short of the previous day’s value, it serves as a bearish signal, pointing towards a potential downturn in market activity.

Neutral Signal:

In instances where the current day’s VHF value aligns with the previous day’s value, the VHF strategy remains neutral.

The neutrality signifies a balance in market conditions, allowing traders to exercise caution and await clearer signals.

Conclusion:

The Vertical Horizontal Filter (VHF) emerges as a formidable tool in the trader’s toolkit, offering insights into the prevailing market dynamics. Its ability to distinguish between trending and ranging markets equips traders with the foresight to deploy suitable indicators and strategies. The bullish and bearish signals derived from VHF variations provide clear directional cues, enabling traders to align their positions with the evolving market trends.

In a landscape where adaptability is key, the VHF stands as a versatile companion, helping traders navigate the complexities of market conditions. Its integration into trading strategies enhances decision-making, fostering a more informed and nuanced approach. As traders seek to master the intricacies of market trends, the Vertical Horizontal Filter proves to be a valuable ally, providing clarity and direction in the ever-changing financial markets.

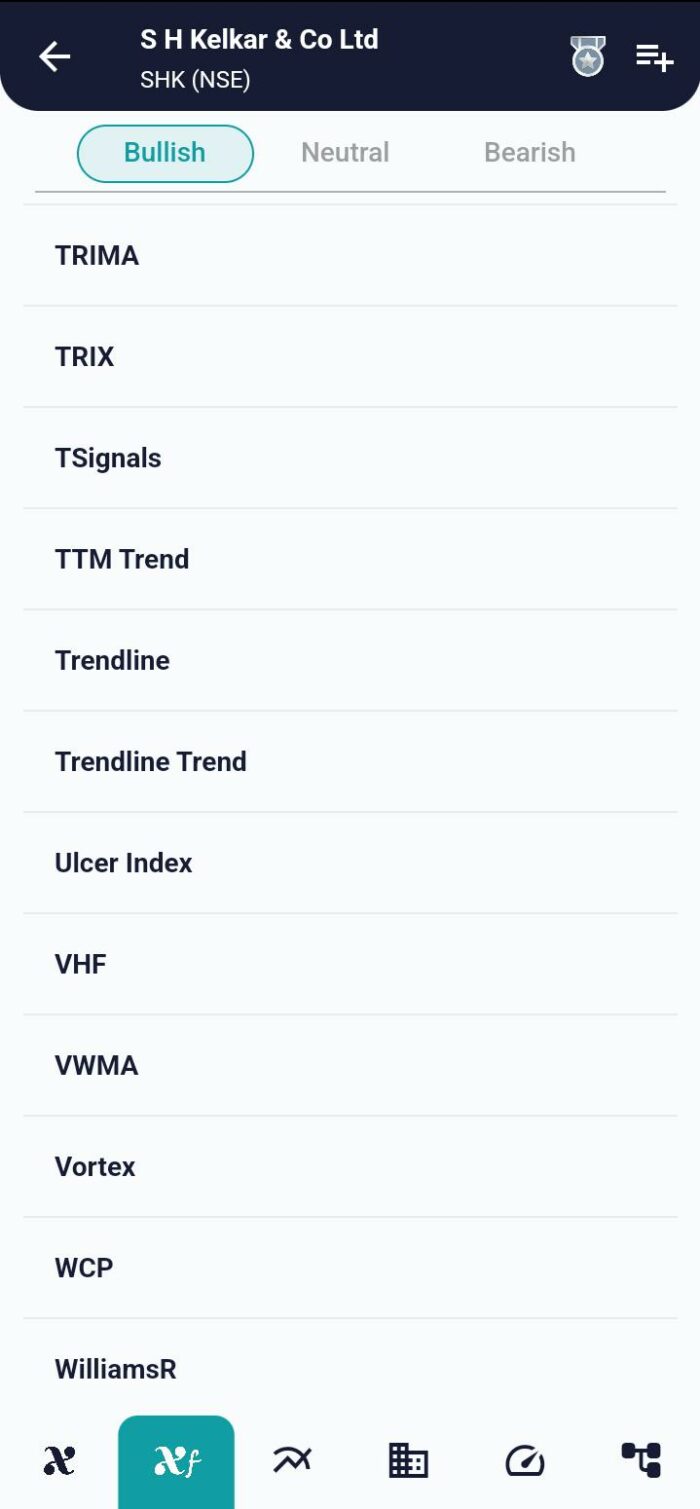

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight