General

Posted On: October 20, 2023

The Power of Forecasting in Investing: A 2 Minute Comprehensive Guide

Forecasting is a fundamental component of investing that enables investors to navigate the financial markets with confidence. By using various techniques, investors can make informed decisions, assess risks and opportunities, and allocate their resources effectively. However, it’s essential to acknowledge the limitations of forecasting and use it in conjunction with other investment strategies. While forecasting can’t provide absolute certainty, it empowers investors to make educated predictions about the future, ultimately enhancing their chances of financial success.

Forecasting in investing involves using historical data and analysis to make predictions about future market trends, asset prices, and economic conditions. Investors utilize this tool to assess risks and opportunities, allocate their capital wisely, and determine the most suitable investment strategies.

Why Is Forecasting Important in Investing?

- Risk Mitigation: Accurate forecasts help investors identify potential risks and develop strategies to mitigate them.

- Opportunity Identification: By forecasting market trends, investors can spot opportunities for capital appreciation and generate profitable returns.

- Asset Allocation: Forecasting aids in determining the optimal allocation of assets, allowing investors to balance risk and return.

Forecasting Techniques in Investing:

- Technical Analysis: This method involves studying historical price and volume data to identify patterns and trends. Technical analysts use tools like moving averages, trendlines, and chart patterns to make predictions about future price movements.

- Fundamental Analysis: Investors assess a company’s financial health and performance by examining factors such as revenue, earnings, and debt. Fundamental analysis relies on metrics like the Price-to-Earnings (P/E) ratio and Price-to-Book (P/B) ratio to estimate the intrinsic value of a stock.

- Quantitative Analysis: Quantitative analysts use mathematical and statistical models to analyze historical data and make predictions about stock prices. This includes time series analysis, regression models, and machine learning algorithms to identify patterns and relationships in the data.

- Market Sentiment Analysis: Monitoring investor sentiment, news sentiment, and options market activity can provide insights into market psychology and help investors make more informed decisions.

Limitations of Forecasting in Investing:

- Uncertainty: The future is inherently uncertain, and unforeseen events can disrupt even the best forecasts.

- Data Accuracy: The quality of forecasts depends on the accuracy of historical data and the assumptions made.

- Overreliance: Overreliance on forecasts can lead to suboptimal investment decisions. It’s crucial to use forecasts as one of many tools in your investment strategy.

- Psychological Bias: Investors may be influenced by biases and emotions when interpreting forecasts, leading to suboptimal decisions.

Conclusion:

Forecasting is a fundamental component of investing that enables investors to navigate the financial markets with confidence. By using various techniques, investors can make informed decisions, assess risks and opportunities, and allocate their resources effectively. However, it’s essential to acknowledge the limitations and use it in conjunction with other investment strategies. While it can’t provide absolute certainty, it empowers investors to make educated predictions about the future, ultimately enhancing their chances of financial success.

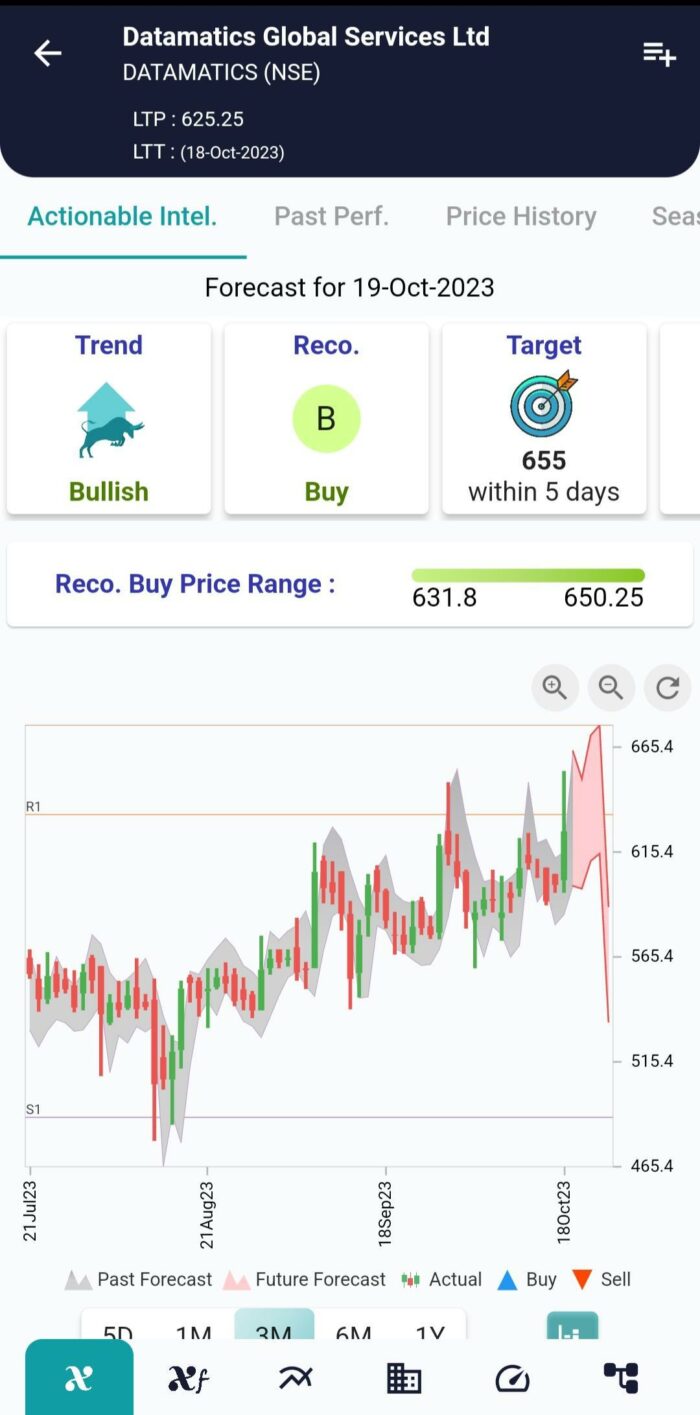

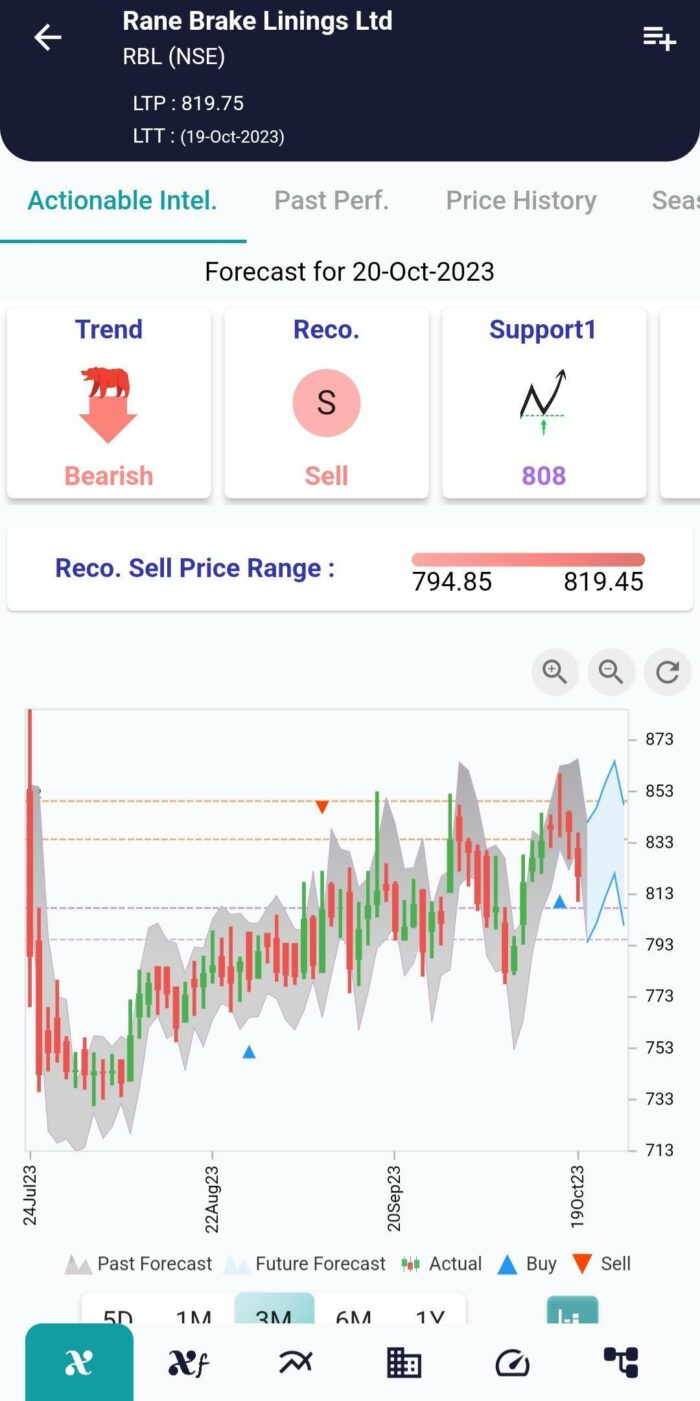

With XCalData, investors can access a comprehensive range of data and tools to supercharge their forecasting and investment strategies. This platform provides advanced stock reports, forecasts, strategies, and predictions, offering a wealth of information to empower investors. Some of the key features and benefits of using XCalData include:

- Candlestick Patterns: Accessing candlestick patterns can help investors identify potential trend reversals or continuation, providing valuable insights for decision-making.

- Technical Ratios and Indicators: Technical analysis is a crucial aspect of Forecasting. XCalData provides access to a variety of technical ratios and indicators, enabling investors to make more informed predictions about price movements.

- Seasonality Analysis: Understanding how a stock or market behaves during specific times of the year can be advantageous for long-term investors. Seasonality data helps in spotting recurring trends.

- Price History: Access to comprehensive price history data allows investors to track past performance and assess how an asset has behaved over time.

- Financial Ratios: Fundamental analysis is essential for evaluating a company’s health and financial performance. XCalData offers financial ratios that can be used to estimate the intrinsic value of a stock.

- Trend Analysis: Recognizing trends is a fundamental part of forecasting. XCalData assists in identifying trends in asset prices, helping investors make decisions based on historical patterns.

- Target Price: Having a target price in mind is vital for setting investment goals. XCalData can provide insights into target prices, aiding in the determination of entry and exit points.

By leveraging the features and capabilities of XCalData, investors can enhance their forecasting accuracy, risk assessment, and decision-making processes. However, it’s crucial to remember that while forecasting is a valuable tool, it should be used in conjunction with other investment strategies, and investors should remain aware of its limitations and the inherent uncertainty of the financial markets. Successful investing requires a well-rounded approach that combines forecasting with prudent risk management and diversified portfolios. For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Also for Wealth Management Platform and Smart BETA Indices you can visit Rhombus AI, It’s a Singapore based fintech specializing in AI-powered platforms, services for financial services and capital markets.

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight