Technical Indicator

Posted On: February 12, 2024

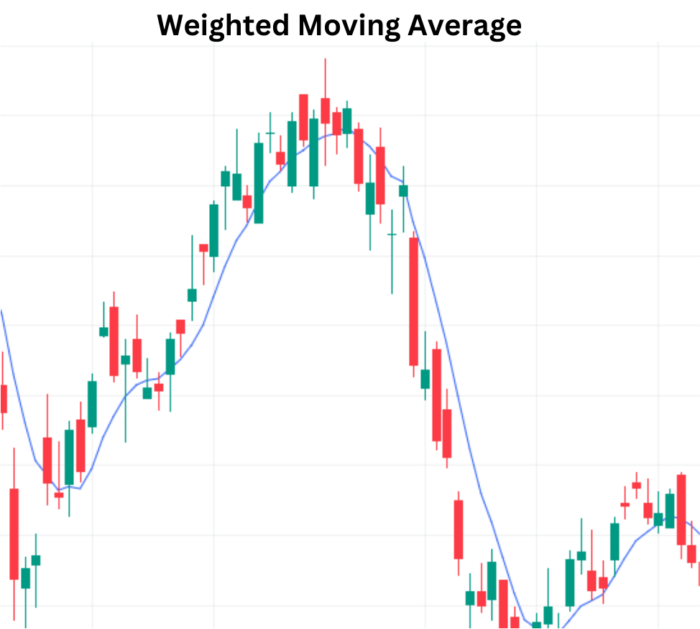

Trade Brilliance with the Power of Weighted Moving Average (WMA)

Introduction:

The Weighted Moving Average (WMA) is a technical indicator used by traders to assess trade direction and make buy or sell decisions. Unlike simple moving averages, the WMA assigns different weights to each data point, placing greater importance on recent observations. The calculation involves multiplying each data point by a predetermined weighting factor to derive a weighted average. Traders often leverage the WMA to identify trends and potential entry or exit points in the market.

Calculation of Weighted Moving Average :

- Calculate the Total Weight:

Total Weight = 0.5 * wma_window * (wma_window + 1)

- Generate the Weights:

weights_ = [1, 2, …, wma_window]

weights = weights_ if asc else [wma_window, wma_window-1, …, 2, 1]

- Calculate the Weighted Moving Average (WMA) for each rolling window of data (x):

WMA = ∑(w i * x i) / Total Weight,

where

i ranges from 1 to wma window. [Default: 10]

Trade Signal Generation:

The trade signal generation is based on a comparison between the Weighted Moving Average values and the closing prices, considering both current and previous values.

- Buy Signal:

- If yesterday’s WMA value is above yesterday’s closing price, and the current WMA value is equal to or less than the current closing price, a “Buy” signal is assigned.

- Sell Signal:

- If yesterday’s WMA value is below yesterday’s closing price, and the current WMA value is equal to or less than the current closing price, a “Sell” signal is assigned.

- Hold:

- If none of the above conditions are met, i.e., the WMA values and closing prices do not align with the specified criteria, the code assigns “Hold.”

Application in Trading:

- Buy Decision:

- A “Buy” signal indicates a potential opportunity to enter a long position. Traders may consider buying the asset when the WMA suggests a favorable trend alignment with closing prices.

- Sell Decision:

- A “Sell” signal suggests a potential opportunity to exit a long position or enter a short position. Traders may consider selling the asset when the WMA indicates a trend misalignment with closing prices.

- Hold Decision:

- A “Hold” signal implies that the current market conditions do not meet the predefined criteria for a clear buy or sell opportunity. Traders may choose to hold existing positions or await more decisive signals.

Conclusion:

In conclusion, the Weighted Moving Average (WMA) serves as a valuable tool for traders to gauge trade direction and make informed decisions. The use of weighted averages allows for a focus on recent price movements, potentially capturing trends more effectively. By incorporating WMA signals based on comparisons with closing prices, traders can develop strategies for entering, exiting, or holding positions in the market. As with any technical indicator, it is advisable to combine the WMA with other analysis techniques for a more comprehensive trading approach.

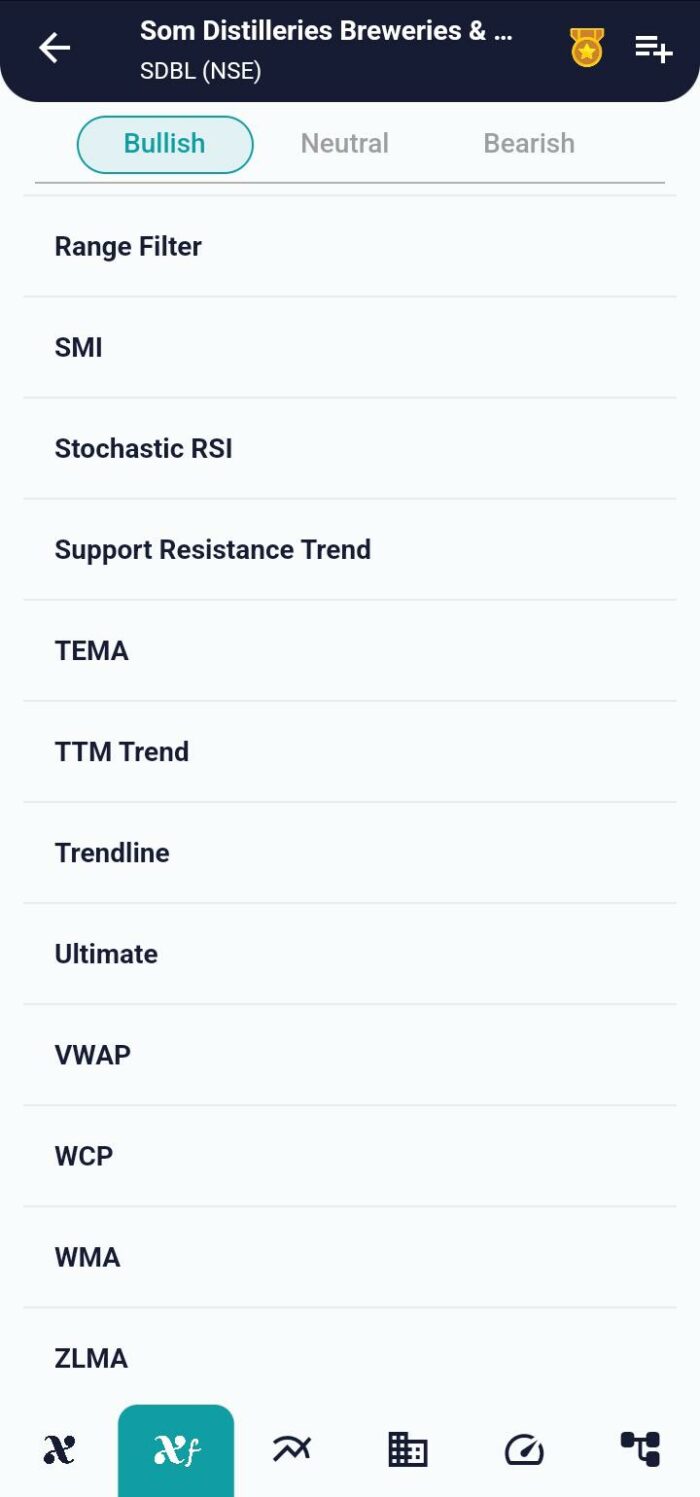

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight