Technical Indicator

Posted On: February 9, 2024

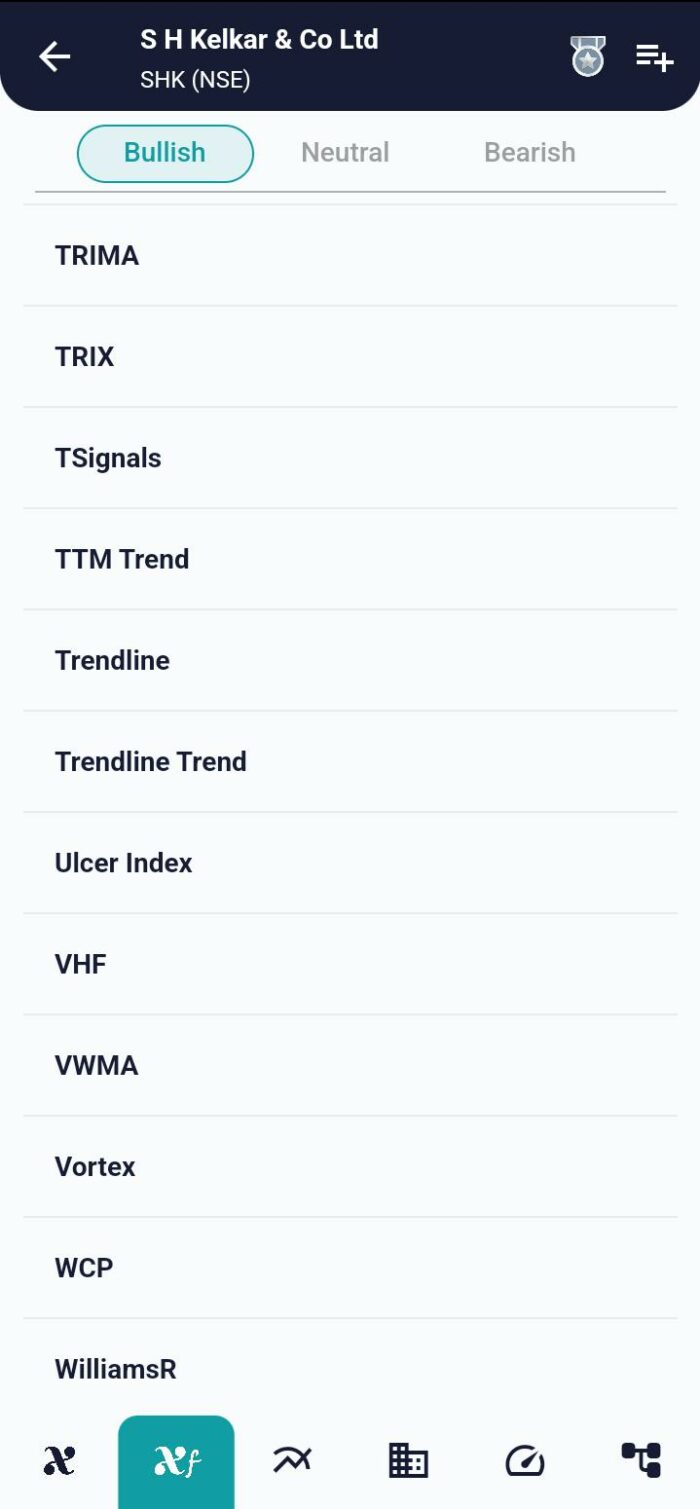

Triangular Moving Average (TRIMA): A Simple Overlap Indicator

Unraveling the Triangular Moving Average:

The Triangular Moving Average (TRIMA) stands out as a unique and powerful technical indicator in the realm of technical analysis. Distinguished by its smoothing effect, TRIMA is essentially a simple moving average that undergoes an additional layer of averaging. This guide delves into the intricacies of TRIMA, offering traders insights into its construction, application, and signals for informed decision-making by using xCaldata app.

Understanding TRIMA:

- Double Averaging Technique:

- Triangular Moving Average is a simple moving average that undergoes a second averaging process, resulting in a more smoothed moving average line.

- The double averaging technique enhances TRIMA’s ability to filter out short-term fluctuations.

- Extra Smoothness:

- TRIMA’s unique feature lies in its extra smoothness compared to traditional moving averages.

- This characteristic makes Triangular Moving Average particularly effective in reducing noise and providing a clearer trend perspective.

Application in Trading:

- Signal Generation:

- TRIMA’s primary application in trading involves signal generation based on changes in its values.

- Signals are generated when the TRIMA value undergoes changes in either direction.

- Bullish Signal:

- A bullish signal occurs when the TRIMA value changes to a higher level from its previous value.

- This signals a potential buying opportunity, indicating an upward shift in the underlying trend.

- Bearish Signal:

- Conversely, a bearish signal manifests when the TRIMA value changes to a lower level from its previous value.

- This signals a potential selling opportunity, suggesting a downward shift in the prevailing trend.

Strategic Decision-Making:

- Trend Confirmation:

- TRIMA serves as a tool for trend confirmation, helping traders validate the direction of the market trend.

- Its smoothing effect aids in identifying the broader trend by filtering out short-term market noise.

- Reducing Lag:

- TRIMA’s design addresses the lag associated with traditional moving averages.

- The extra smoothness reduces lag, providing traders with more responsive insights into evolving market conditions.

Integration into Trading Strategies:

- Trend-Following Strategies:

- TRIMA is often integrated into trend-following strategies, where its smoothness enhances trend visibility.

- Traders may use TRIMA crossovers or directional changes as entry and exit signals.

- Noise Reduction:

- TRIMA’s proficiency in noise reduction makes it suitable for volatile markets, contributing to more accurate decision-making.

- It excels in scenarios where a clear trend signal is essential amid market fluctuations.

Conclusion:

The Triangular Moving Average (TRIMA) emerges as a valuable asset for traders seeking a refined and smoothed approach to trend analysis. With its double averaging technique, TRIMA goes beyond traditional moving averages, offering enhanced clarity and reduced lag. Traders can harness TRIMA’s signals for strategic decision-making, whether confirming trends, identifying entry points, or navigating volatile market conditions. As an integral component of technical analysis, TRIMA empowers traders with a versatile tool that adapts to various trading styles and market dynamics.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight