Technical Indicator

Posted On: February 9, 2024

Ultimate Momentum Mastery with Ultimate Oscillator

Introduction:

Embark on a journey through market momentum with the Ultimate Oscillator, a powerful technical analysis technical indicator meticulously crafted by Larry Williams. Designed to measure momentum and unveil potential trend reversals in financial markets, this oscillator stands as a beacon for traders navigating the complexities of price movements. By ingeniously combining insights from three distinct time periods, the Ultimate Oscillator offers a comprehensive view of buying and selling pressure, empowering traders with nuanced signals for strategic decision-making.

Key Components of Ultimate Oscillator:

- Ultimate Oscillator:

- A dynamic tool that measures momentum and aids in identifying potential trend reversals.

- Developed by Larry Williams, the Ultimate Oscillator combines insights from three timeframes (seven, 14, and 28 periods) to generate comprehensive trading signals.

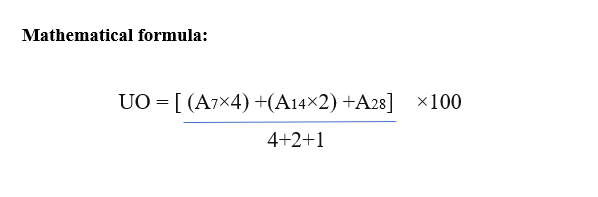

Where,

UO=Ultimate Oscillator

A=Average

Buying Pressure (BP)=Close−Min (Low,PC)

PC=Prior Close True Range

(TR) =Max (High,Prior Close) – Min (Low,Prior Close)

Avg 7= ∑p=1to7 BP/TR

Avg 14= ∑p=1to14 BP/TR

Avg 28= ∑p=1to28 BP/TR

Signal Generation Criteria:

- Buy Signal:

- Triggered when the Ultimate Oscillator value falls below the Oversold threshold, and a divergence pattern is observed.

- This configuration signals a potential buying opportunity, indicating that market conditions may be ripe for a trend reversal or upward movement.

- Sell Signal:

- Activated when the Ultimate Oscillator value rises above the Overbought threshold, accompanied by a divergence pattern.

- A sell signal emerges, suggesting that the market is potentially overbought, and a trend reversal or downward movement may be on the horizon.

Strategic Implications:

- Comprehensive Momentum Analysis:

- The Ultimate Oscillator’s incorporation of three timeframes provides traders with a holistic view of market momentum.

- By considering buying and selling pressure over varying periods, traders gain deeper insights into the prevailing market dynamics.

- Confirmation of Price Trends:

- Traders utilize the Ultimate Oscillator to confirm existing price trends and identify potential shifts in market sentiment.

- The oscillator’s ability to detect divergences enhances its role in validating the sustainability of price movements.

Implementation Strategies:

- Divergence Recognition:

- Traders keen on spotting trend reversals leverage the Ultimate Oscillator’s divergence patterns.

- Divergence between price movements and oscillator readings serves as a strategic signal for potential trend shifts.

- Overbought and Oversold Conditions:

- The Ultimate Oscillator’s Overbought and Oversold thresholds guide traders in assessing market conditions.

- Overbought conditions may prompt a cautious approach or potential selling, while oversold conditions could signal buying opportunities.

Conclusion:

In the realm of technical analysis, the Ultimate Oscillator emerges as a versatile and robust tool for traders seeking mastery over market momentum. Larry Williams’ creation, with its unique blend of three timeframes, offers a nuanced perspective on buying and selling pressure. Whether confirming price trends, detecting divergences, or signaling potential reversals, the Ultimate Oscillator remains a valuable companion in the trader’s toolkit. Its ability to synthesize insights from varying time periods underscores its relevance in navigating the ever-evolving landscape of financial markets.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight