Technical Indicator

Posted On: February 12, 2024

Understanding Weighted Close Price (WCP) Indicator for Trading Signals

Introduction:

The Weighted Close Price (WCP) technical indicator is a specialized tool that derives the mean of the high, low, and close prices of a trading bar. It assigns double weight to the close price, offering a unique perspective on market dynamics. Traders leverage the WCP to identify potential buy or sell signals based on the relationship between the WCP value and the closing price.

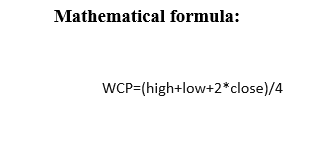

Calculation Weighted Close Price:

- Mean Calculation:

- WCP calculates the mean using the high, low, and close prices of a given bar.

- The close price is assigned double weight in this calculation, accentuating its impact on the final result.

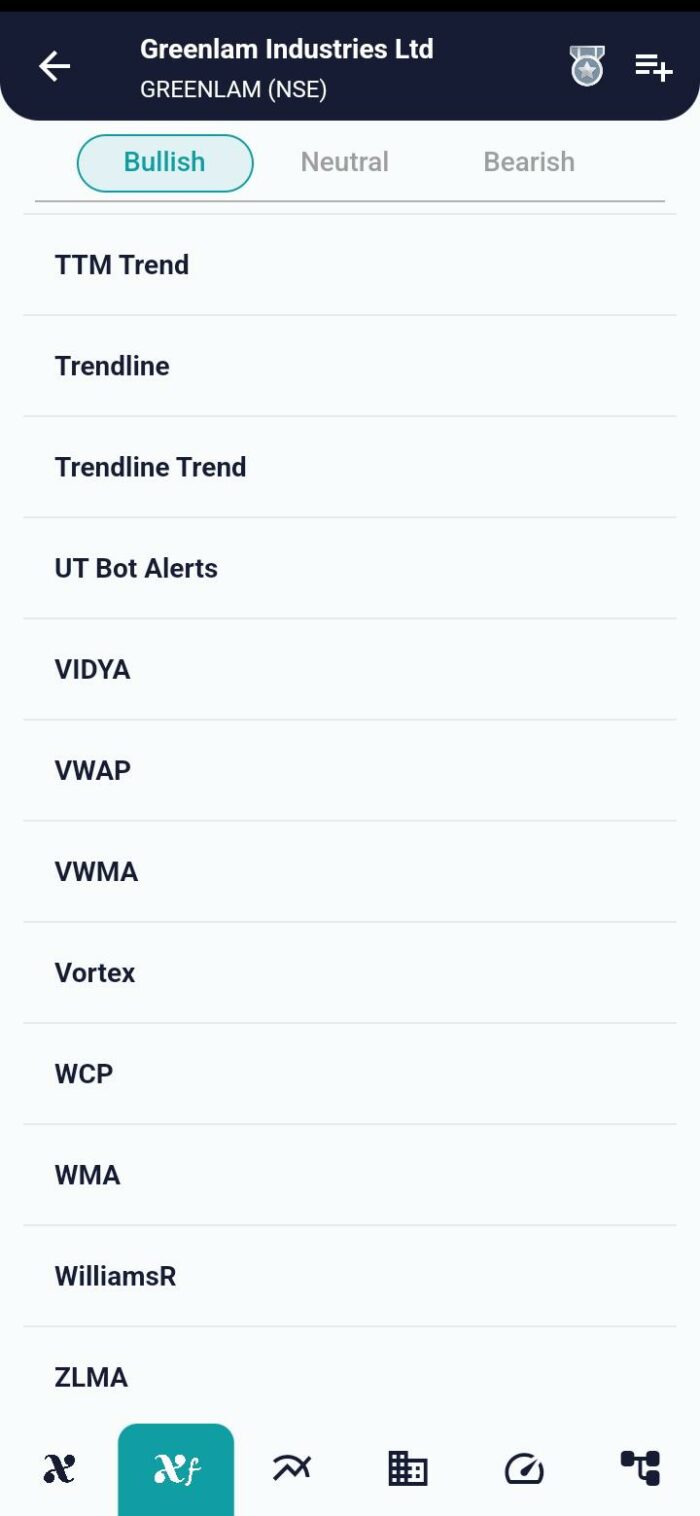

Interpretation of Signals:

- Bullish Signal – WCP < Close:

- A buy signal is generated when the Weighted Close Price value is less than the close price.

- This scenario suggests that the close price, with its double weight, is relatively strong compared to the mean of the high, low, and close.

- Bearish Signal – WCP > Close:

- Conversely, a sell signal is indicated when the Weighted Close Price value exceeds the close price.

- This situation implies that the close price, despite its double weight, is weaker compared to the calculated mean.

Trading Implications:

- Buy Signal – Strength in Close Price:

- Traders interpreting a bullish signal may consider initiating long positions.

- The emphasis on the strength of the close price in the Weighted Close Price calculation suggests potential upward momentum.

- Sell Signal – Weakness in Close Price:

- Traders responding to a bearish signal might contemplate short positions or exercise caution in existing long positions.

- The indication of relative weakness in the close price, despite its double weight, implies potential downward pressure.

Integration with Other Indicators:

- Confirmation through Additional Analysis:

- While the Weighted Close Price provides valuable insights, traders often seek confirmation through additional technical indicators or analysis techniques.

- Combining the Weighted Close Price with other tools enhances the robustness of trading decisions.

Conclusion:

In conclusion, the Weighted Close Price (WCP) indicator serves as a specialized metric in technical analysis, emphasizing the significance of the close price in market dynamics. Traders utilizing the WCP carefully evaluate the relationship between the WCP value and the close price to derive meaningful buy or sell signals. The double weighting of the close price underscores its impact on the indicator’s calculation, providing traders with a nuanced perspective on the strength or weakness of the closing price in relation to the overall price action. As with any technical indicator, traders often integrate the WCP into a broader toolkit for comprehensive analysis, leveraging its insights to make informed decisions in the dynamic landscape of financial markets.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight