Strategy

Posted On: January 18, 2024

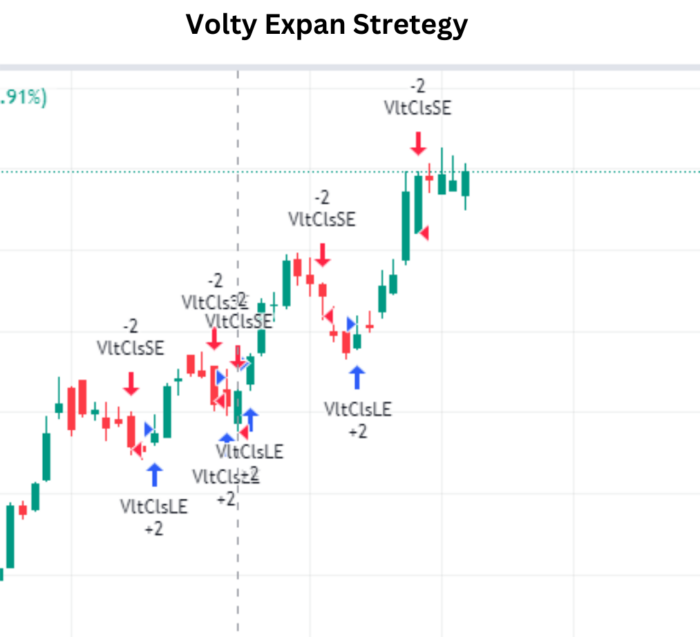

Unleashing Market Dynamics: The Volatility Expansion Strategy

In the realm of sophisticated trading strategies, the Volatility Expansion Strategy takes center stage, offering traders a nuanced approach to identify potential breakouts, breakdowns, or sudden surges in price action. This blog post will delve into the intricacies of the Volatility Expansion Strategy, providing a comprehensive definition, summarizing its operational principles, and shedding light on its application for traders seeking precision in dynamic market conditions in this blog post and showing you how to use this effective tool using the xCaldata App.

Deciphering the Volatility Expansion Strategy

The Volatility Expansion Strategy is engineered to navigate the complexities of market volatility by creating a channel based on the Average True Range (ATR) over a specified number of bars. This channel serves as a dynamic framework, adapting to changing volatility conditions and providing a basis for informed trading decisions.

Key Components of the Strategy

- Channel Creation: The strategy forms a channel using the Average True Range for the last X bars, multiplied by a user-defined factor. This channel is constructed by adding and subtracting the resulting value from the close.

- Long Entry Condition: If the current bar’s price surpasses the upper band from the previous bar, a long order is generated. This condition identifies potential breakouts to the upside.

- Short Entry Condition: Conversely, if the current bar’s price falls below the lower band from the previous bar, a short order is initiated. This condition identifies potential breakdowns to the downside.

Optimizing the Volatility Expansion Strategy

Customizing ATR Length and Factor:

- Traders can optimize the strategy by adjusting the length of the ATR and the factor. Shorter ATR lengths may capture more immediate volatility, while higher factors may widen the channel for increased sensitivity to price movements.

Adapting to Market Conditions:

- Consider adapting the strategy’s parameters based on prevailing market conditions. Higher volatility may warrant a larger factor or a longer ATR length, while lower volatility may require adjustments for precision.

Application for Breakouts and Breakdowns

Identifying Breakouts:

- The Volatility Expansion Strategy is adept at identifying potential breakouts when the current bar’s price surpasses the upper band, signaling an expansion in volatility and a potential upward movement.

Spotting Breakdowns:

- Conversely, the strategy excels at identifying breakdowns when the current bar’s price falls below the lower band, indicating a contraction in volatility and a potential downward movement.

Conclusion: Precision in Volatile Markets

In conclusion, the Volatility Expansion Strategy stands as a sophisticated tool for traders navigating volatile markets. By leveraging the dynamic channel created through ATR, the strategy provides traders with insights into potential breakouts, breakdowns, or sudden shifts in price action. As traders fine-tune the ATR length, experiment with different factors, and adapt their approach to market conditions, the Volatility Expansion Strategy becomes an invaluable asset in their toolkit for mastering market dynamics with precision in the ever-evolving financial markets.

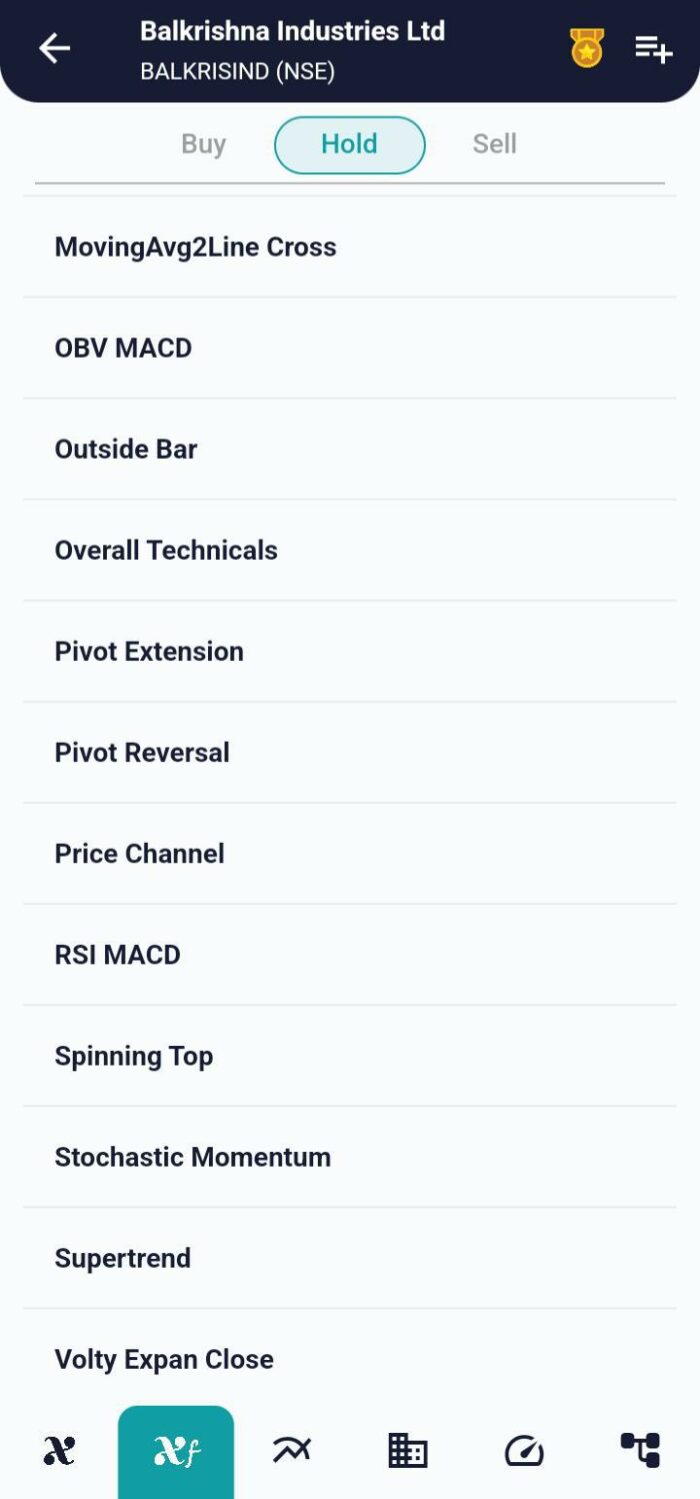

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight