Technical Indicator

Posted On: January 30, 2024

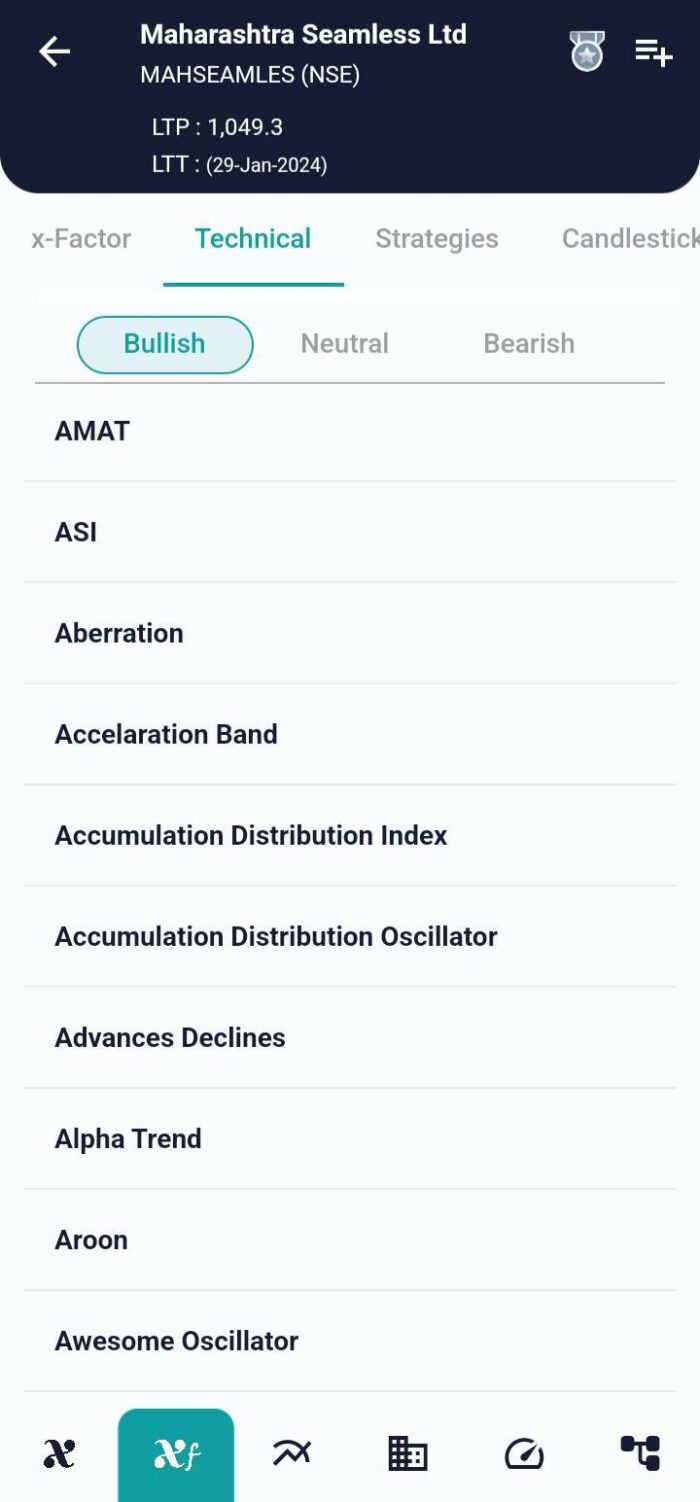

Unleashing the Alpha Trend Indicator: Navigating Market Challenges with Precision

In the dynamic realm of financial markets, traders are continually seeking tools that provide accurate signals, minimize stop losses, and adapt to diverse market conditions. The Alpha Trend technical indicator designed to address challenges faced by its predecessor, Magic Trend, emerges as a powerful solution. This blog explores the features and capabilities of Alpha Trend, shedding light on how it empowers traders to navigate the complexities of today’s markets.

Minimizing Stop Losses and Sideways Markets:

One of Alpha Trend’s primary objectives is to minimize stop losses, a crucial aspect of effective risk management. In sideways market conditions, Alpha Trend acts as a dormant indicator, avoiding unnecessary signals and false alarms. This characteristic enhances the accuracy of trades, enabling traders to approach volatile markets with greater confidence and precision.

Accurate BUY/SELL Signals in Trending Markets:

During trending market conditions, Alpha Trend excels by delivering precise BUY and SELL signals through crossovers with another line. This feature provides traders with a clearer picture of market trends, allowing them to capitalize on emerging opportunities and make timely decisions.

Support and Resistance Dynamics:

Beyond signaling trends, Alpha Trend plays a dual role as significant support and resistance levels. In uptrends, it acts as support by trailing 1ATR distance from bar lows, while in downtrends, it acts as resistance by trailing 1ATR distance from bar highs. This dynamic behavior enhances the indicator’s utility for identifying trends and managing trades effectively.

Integration of Different Indicators:

A key strength of Alpha Trend lies in its integration of indicators from different categories. By combining CCI, ATR, MFI, and RSI, Alpha Trend offers a holistic approach to market analysis. Each indicator contributes unique insights into momentum, trend, volatility, volume, and trailing stop loss, allowing traders to make more informed decisions.

Operationalizing Alpha Trend:

Understanding how to use Alpha Trend involves recognizing its various roles. In sideways markets, it minimizes false signals, acting as a dead indicator. When crossovers occur, generating BUY and SELL signals, traders can confidently act on emerging trends. The support and resistance levels, coupled with trailing stop loss functionality, further enhance the trader’s ability to manage risk effectively.

Customization and Default Values:

Alpha Trend provides flexibility for traders to customize settings based on their strategies and preferences. Default values, including the coefficient (trailing ATR value factor) and common period (length of ATR, MFI, and RSI), serve as a starting point for traders to tailor the indicator to their specific needs.

Conclusion:

In conclusion, Alpha Trend represents a significant leap in technical analysis, offering traders a sophisticated yet user-friendly tool. As traders grapple with the challenges of evolving market dynamics, Alpha Trend stands as a reliable companion, providing actionable insights and supporting strategic decision-making. Whether identifying trends, managing risk, or fine-tuning entry and exit points, Alpha Trend exemplifies precision in the pursuit of profitable trades.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight