Technical Indicator

Posted On: February 9, 2024

Unlocking Market Potential with Trend Signals (TSignals)

Introduction:

Welcome to the realm of Trend Signals (TSignals), a technical indicator designed to discern and act upon the nuanced interplay between signals and trends. In the vast landscape of financial markets, the terms “SIGNAL” and “TREND” resonate as pivotal concepts, each holding a distinct significance. While a signal serves as a transient indication of directional shifts in the short term, a trend embodies the enduring patterns and movements dictating long-term market dynamics.

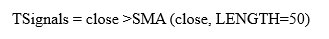

Key Components of Trend Signals:

- TSignals Value:

- The crux of TSignals lies in its binary values — 0 and 1 — encapsulating the ebb and flow of market dynamics.

- TSignals serves as a compass, guiding traders through the intricate dance of signals and trends.

Signal Generation Criteria:

- Buy Signal:

- Triggered when the current day’s Trend Signals value is 1, and the previous day’s TSignals value is 0.

- This configuration signifies a call to action, prompting traders to consider potential buying opportunities.

- Sell Signal:

- Illuminates when the current day’s Trend Signals value is 0, and the previous day’s TSignals value is 1.

- A sell signal indicates a shift in sentiment, prompting traders to assess potential selling opportunities.

- Hold Position:

- When TSignals values remain unchanged (0 or 1) across consecutive days, a hold position is recommended.

- Holding reflects a strategic pause, allowing traders to navigate market fluctuations without an immediate shift in position.

Strategic Implications:

- Short-Term vs. Long-Term Dynamics:

- TSignals adeptly distinguishes between short-term signals and long-term trends.

- Traders can utilize buy and sell signals to optimize short-term maneuvers while adopting a holistic view of long-term trends.

- Dynamic Decision-Making:

- TSignals empowers traders with real-time insights, facilitating dynamic decision-making.

- Rapid responses to changing market conditions become feasible with the clarity provided by TSignals.

Implementation Strategies:

- Signal-Based Strategies:

- Traders can integrate Trend Signals into their arsenal for signal-centric strategies.

- Buy and sell signals act as triggers, guiding entry and exit points in alignment with short-term market dynamics.

- Holistic Trend Analysis:

- TSignals serves as a foundation for comprehensive trend analysis.

- By observing patterns in buy and sell signals over extended periods, traders gain insights into evolving long-term trends.

Conclusion:

Trend Signals (TSignals) emerges as a versatile model, harmonizing the dichotomy of signals and trends in the ever-evolving landscape of financial markets. Whether navigating short-term fluctuations or deciphering enduring trends, TSignals stands as a beacon for traders seeking clarity and actionable insights. The strategic interplay between buy, sell, and hold signals equips traders with the tools needed to make informed decisions in alignment with their market objectives. As trends unfold and signals illuminate potential opportunities, the judicious integration of TSignals into trading strategies unveils a pathway for traders to navigate the complexities of market dynamics with confidence and precision.

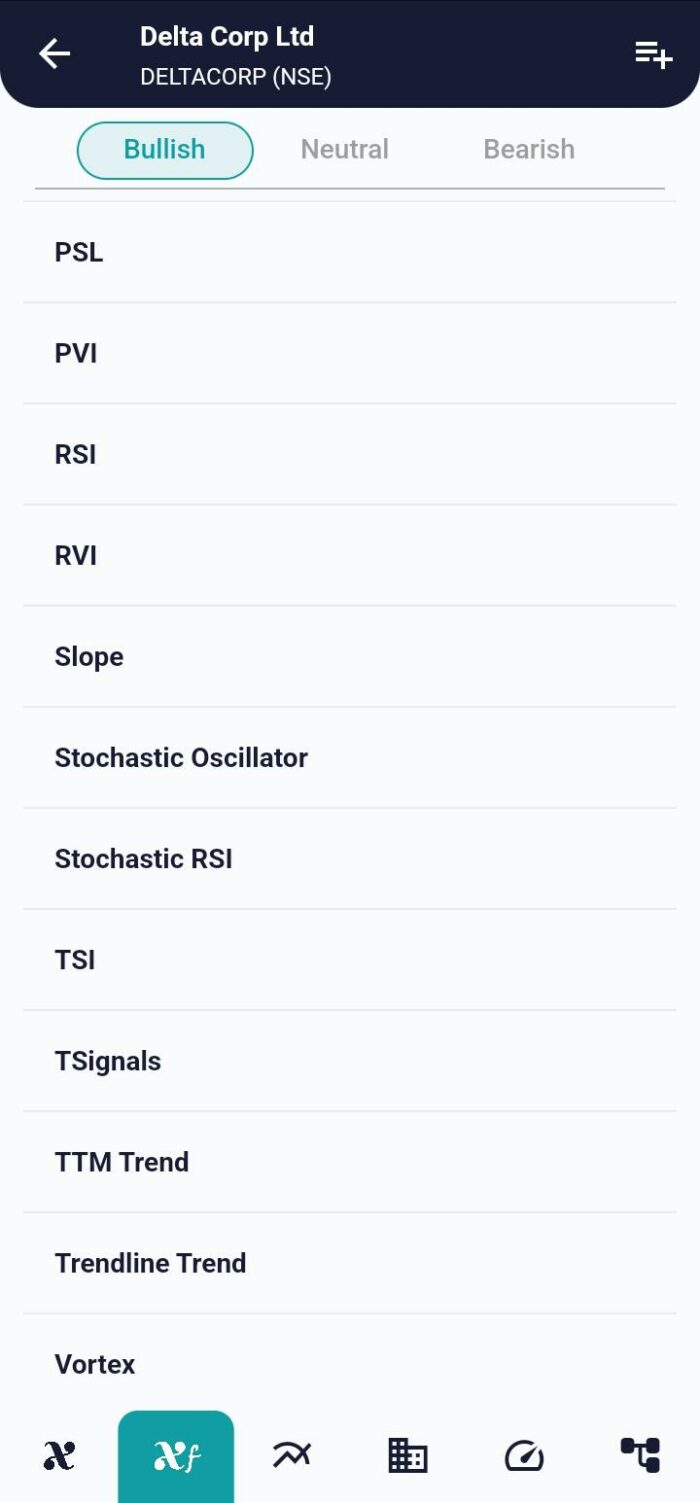

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight