Technical Indicator

Posted On: February 2, 2024

Unlocking Market Secrets with Detrended Price Oscillator (DPO)

In the intricate landscape of financial markets, having tools that decode historical patterns and forecast future trends is crucial. The Detrended Price Oscillator (DPO) technical indicator emerges as a valuable ally for traders seeking to measure the distance between price peaks and troughs, offering insights into potential buying or selling opportunities. Let’s delve into the intricacies of DPO and uncover its applications in strategic decision-making.

Understanding the Detrended Price Oscillator (DPO):

The DPO functions by detaching the moving average from the price, allowing traders to identify cyclic patterns in historical price data. This detachment aids in revealing the underlying price cycles and potential reversal points.

Setting the Timeframe:

Traders typically set the DPO to look back over 20 to 30 periods, providing a balanced view of historical price movements without being overly sensitive to short-term fluctuations.

Calculation

DPO = Close (n/2 + 1 Periods ago) – n Period SMA

here, SMA=Simple Moving Average.

Navigating DPO Signals: A Tactical Approach

Bullish Signals:

- Positive DPO Value:

- A DPO value above zero signals a bullish trend.

- Rising DPO:

- An ascending DPO indicates strengthening bullish momentum.

- Bullish Reversal:

- A falling DPO following a period of positive values may signify a potential bullish reversal.

Bearish Signals:

- Negative DPO Value:

- A DPO value below zero indicates a bearish trend.

- Falling DPO:

- A descending DPO suggests intensifying bearish momentum.

- Bearish Reversal:

- A rising DPO subsequent to a period of negative values may hint at an impending bearish reversal.

Strategic Implementation of DPO Insights

Buying Opportunities:

- Identifying Troughs:

- Locate estimated future troughs using historical DPO patterns.

- Buying Signals:

- Consider buying opportunities around estimated future troughs identified by the DPO.

Selling Opportunities:

- Spotting Peaks:

- Identify potential peaks by analyzing historical DPO patterns.

- Selling Signals:

- Strategically plan selling opportunities around estimated future peaks highlighted by the DPO.

Conclusion: Navigating Markets with DPO Precision

Incorporating the Detrended Price Oscillator into your trading arsenal provides a unique perspective on market dynamics. By uncovering cyclic patterns and signaling potential reversal points, the DPO empowers traders to make informed decisions. Whether you’re a seasoned trader or exploring the realms of financial markets, leveraging DPO insights enhances your ability to navigate markets with precision. Embrace the power of the Detrended Price Oscillator and embark on a journey of strategic and informed trading decisions.

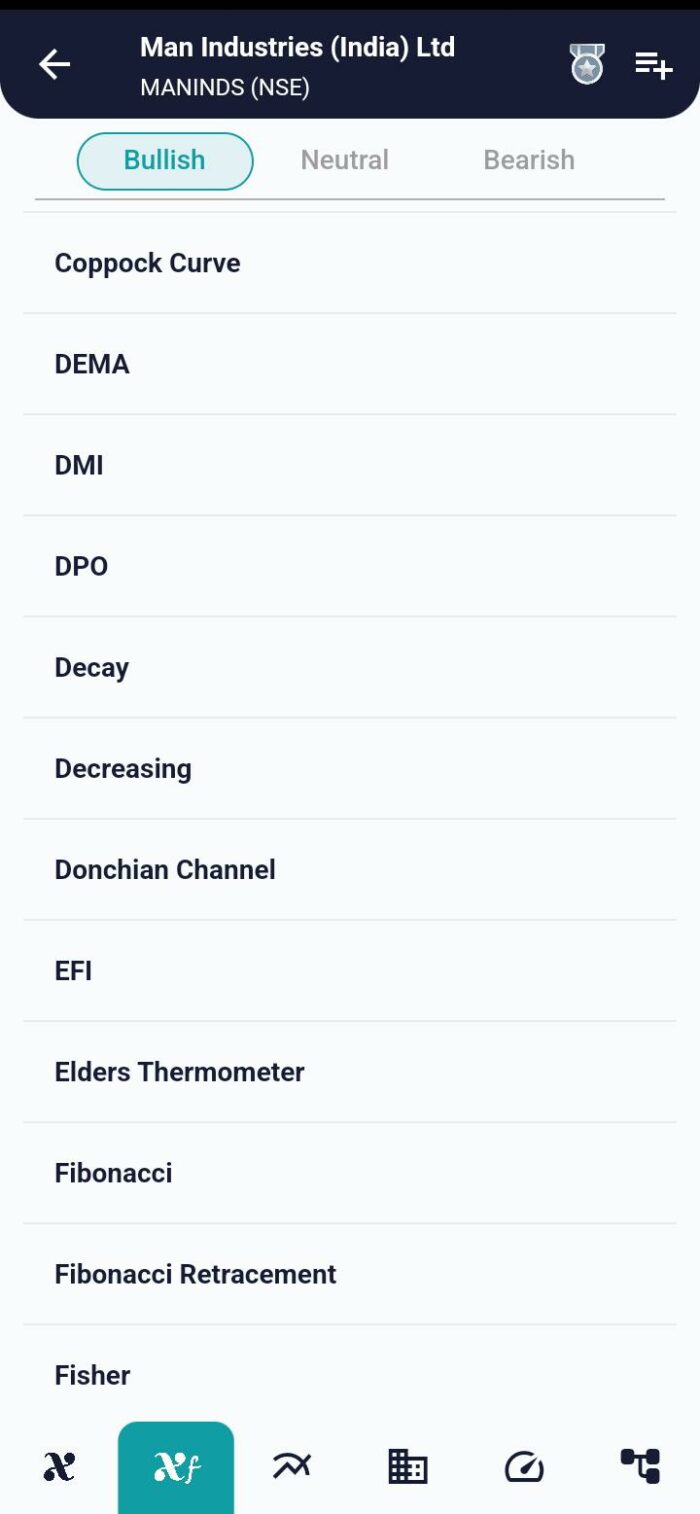

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight