Technical Indicator

Posted On: February 7, 2024

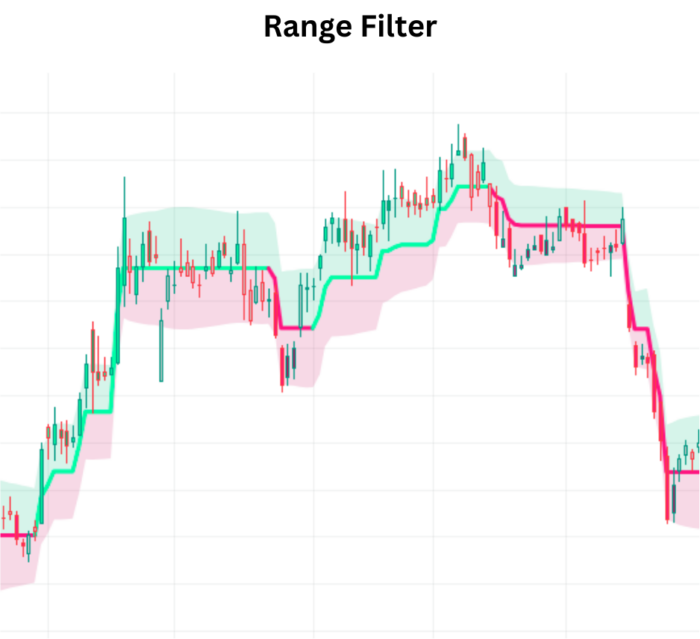

Unlocking Profits with the Range Filter Indicator

Introduction:

Are you ready to elevate your trading game and achieve consistent profits? Look no further than the opening range breakout strategy, bolstered by the powerful Range Filter technical indicator . In this comprehensive guide, we’ll delve into the intricacies of this strategy, providing you with the knowledge and tools needed to succeed in today’s dynamic markets.

Understanding Opening Range Breakout Strategy:

The opening range breakout strategy revolves around identifying a price range within the first few minutes of market opening and executing trades when prices break out of this range. While seemingly straightforward, this strategy demands meticulous analysis and disciplined execution to capitalize on market opportunities effectively.

The Versatility of Opening Range Breakout:

One of the key advantages of the opening range breakout strategy is its adaptability. It can be applied across various markets and timeframes, providing traders with the flexibility to tailor their approach to different trading conditions. Whether you’re a novice or seasoned trader, this strategy offers a versatile framework for navigating the markets.

Enter the Range Filter Indicator:

The Range Filter indicator emerges as a crucial tool in executing the opening range breakout strategy. This indicator analyzes price movements during the first five minutes of trading, identifying key support and resistance levels to facilitate precise entry and exit points for trades. Its intuitive interface and proven track record make it an indispensable asset for traders of all levels.

Backtesting for Enhanced Performance:

To gauge the effectiveness of your opening range breakout strategy, thorough backtesting is essential. By testing various parameters and analyzing historical data, you can refine your approach, optimize risk management techniques, and maximize profitability. Backtesting provides valuable insights into the performance of your strategy under different market conditions, empowering you to make informed decisions.

Incorporating Trend Filters for Accuracy:

To further enhance the accuracy of your opening range breakout strategy, consider incorporating trend filters into your analysis. Trend filters, such as moving averages, Bollinger Bands, and Relative Strength Index (RSI), help identify trend direction and filter out noise and false signals. By combining the Range Filter indicator with trend filters, you can make more informed trading decisions and increase your success rate.

The Guikroth Formula for Precision: The Guikroth Formula emerges as a powerful tool for creating effective range filter indicators. By leveraging this formula, traders can identify key levels of support and resistance with precision, enabling them to make informed trading decisions. With its versatility and applicability across different timeframes, the Guikroth Formula adds a layer of sophistication to the opening range breakout strategy.

Conclusion:

The opening range breakout strategy, complemented by the Range Filter indicator and other technical analysis tools, presents a formidable approach to navigating today’s financial markets. By mastering this strategy, conducting thorough backtesting, and incorporating trend filters and advanced formulas, traders can unlock their full potential and achieve consistent profits. Embrace the power of the opening range breakout strategy and embark on a journey towards trading success.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight