Technical Indicator

Posted On: February 7, 2024

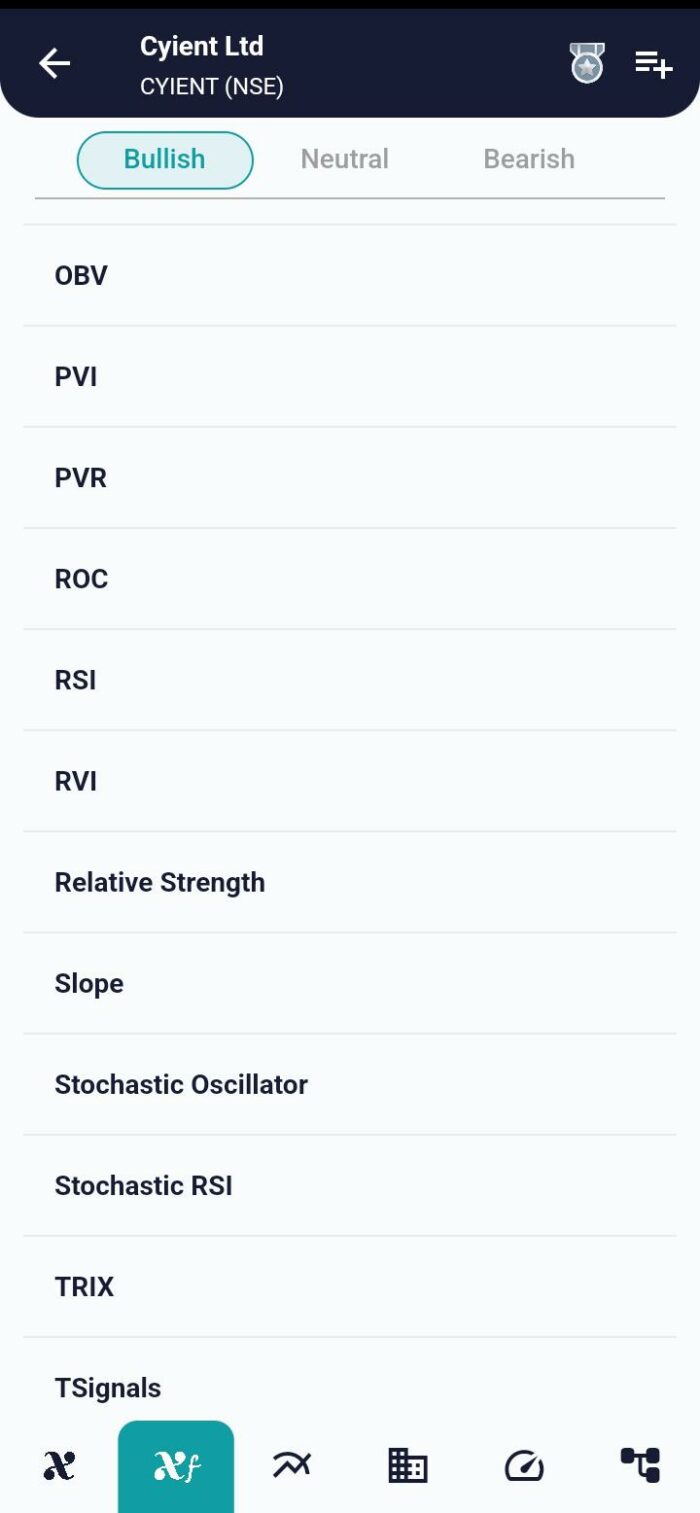

Unlocking Trends with the Power of Price Volume Rank Indicator

Introduction:

Price Volume Rank

In the ever-evolving landscape of financial markets, traders and investors constantly seek innovative tools to decipher market trends and make informed decisions. One such tool that shines in this endeavor is the Price Volume Rank (PVR) technical indicator . This guide delves into the intricacies of the PVR study, exploring its methodology, interpretation, and its role in signaling buy or sell opportunities.

Unveiling the Price Volume Rank Indicator:

The Price Volume Rank (PVR) study is a technical indicator designed to assess the relationship between the close price and trading volume. By comparing current values with their previous counterparts, the PVR assigns ranks based on specific conditions. These ranks serve as valuable signals for traders to navigate the complex dynamics of the market.

Understanding PVR Signals:

Buy Signal:

- Condition: If the current day’s ‘pvr_fast’ value is less than the current day’s ‘pvr_slow,’ and the previous day’s ‘pvr_fast’ value is greater than the previous day’s ‘pvr_slow.’

- Interpretation: This scenario indicates a Buy signal, suggesting a potential upward momentum in the market.

Sell Signal:

- Condition: If the current day’s ‘pvr_fast’ value is greater than the current day’s ‘pvr_slow,’ and the previous day’s ‘pvr_fast’ value is less than the previous day’s ‘pvr_slow.’

- Interpretation: This scenario signals a Sell opportunity, indicating a potential downturn in the market.

Hold:

- Condition: If none of the above conditions are met.

- Interpretation: The absence of specific conditions suggests a neutral stance, advising traders to hold their current positions.

Strategies for Implementation:

- Confirmation of Trend Reversals:

- Leverage PVR signals to confirm potential trend reversals, particularly when the fast PVR is transitioning from being greater to lesser than the slow PVR, or vice versa.

- Integration into Trading Strategies:

- Incorporate PVR signals into broader trading strategies, using them as complementary insights to enhance decision-making.

- Risk Management:

- Utilize PVR indications to assess risk levels and adjust positions accordingly, aligning with the prevailing market sentiment.

Conclusion:

The Price Volume Rank (PVR) indicator emerges as a valuable tool for traders aiming to discern market trends and capitalize on potential opportunities. By considering the interplay between close prices and trading volumes, the PVR study provides actionable signals that can guide traders in navigating the dynamic and ever-changing landscape of financial markets.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight