Technical Indicator

Posted On: January 30, 2024

Unveiling BIAS Indicator:

A Comprehensive Guide to Trading

In the dynamic world of financial markets, successful traders rely on a myriad of technical indicators to make informed decisions. One such essential tool is the BIAS (Basic Bias) technical indicator , a powerful instrument that provides valuable insights into market sentiment. Understanding how to interpret and utilize BIAS can significantly enhance your trading strategies.

Understanding BIAS: A Brief Overview

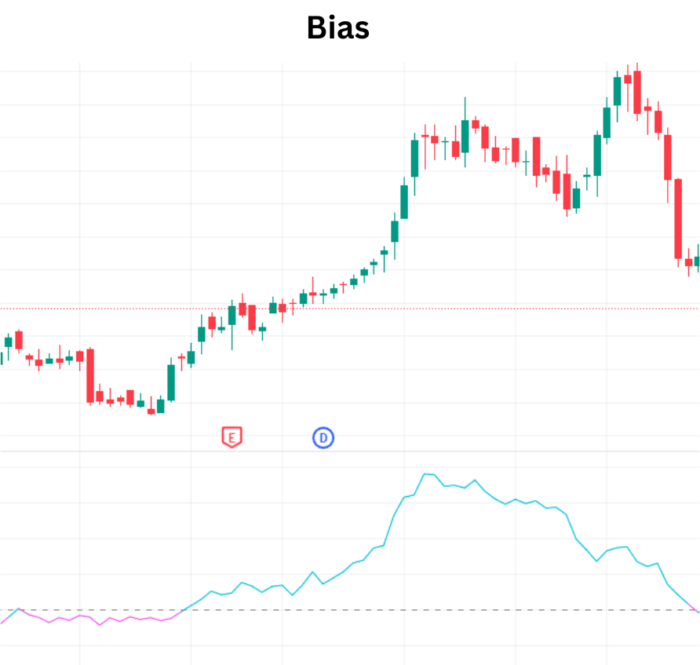

The BIAS indicator is a technical tool designed to determine the directional bias of a market or security. Traders and analysts use it to gauge whether the prevailing sentiment is bullish, bearish, or neutral. At its core, BIAS helps in assessing the degree of deviation between the stock price and its moving average over a specific period.

The Mathematics Behind BIAS

The mathematical formula for calculating BIAS is relatively straightforward, making it accessible for traders at all levels. The formula is expressed as:

BIAS = [(Closing price of the day — N-day average price) / N-day average price ] * 100%].

In essence, BIAS reflects the percentage difference between the closing price of an asset and its N-day average price. The resulting value provides a quantitative measure of the market’s bias, indicating whether it tends towards bullishness, bearishness, or neutrality.

Interpreting BIAS: Navigating Market Sentiment

Interpreting the BIAS indicator involves analyzing its numeric values and understanding their implications for market sentiment.

- Bullish Bias (BIAS > 0): A BIAS value greater than 0 signifies a bullish sentiment. In this scenario, the closing price is above the N-day average price, indicating a potential uptrend. Traders may consider looking for buying opportunities or holding onto existing long positions.

- Neutral Bias (BIAS = 0): A BIAS value of 0 suggests a neutral sentiment. In such cases, the closing price aligns closely with the N-day average price, indicating a balance between bullish and bearish forces. Traders might exercise caution and await clearer signals before making significant moves.

- Bearish Bias (BIAS < 0): A BIAS value less than 0 indicates a bearish sentiment. The closing price is below the N-day average price, suggesting a potential downtrend. Traders may explore short-selling opportunities or consider exiting long positions.

Incorporating BIAS into Your Trading Strategy

Now that we’ve unraveled the intricacies of BIAS, let’s explore how traders can integrate this valuable tool into their trading strategies.

1. Trend Confirmation:

BIAS can serve as a reliable confirmation tool for identifying trends. When coupled with other technical indicators, such as moving averages or trendlines, BIAS can help traders validate the strength and sustainability of a trend.

2. Reversal Signals:

Sudden shifts in BIAS values can indicate potential trend reversals. Traders should monitor significant changes in BIAS, especially when it transitions from bullish to bearish or vice versa. These crossovers can present lucrative opportunities for entering or exiting positions.

3. Risk Management:

Incorporating BIAS into risk management strategies is crucial. Traders can use BIAS values to set stop-loss levels, ensuring that positions are protected in the event of unexpected market movements. Understanding the prevailing sentiment can guide traders in implementing effective risk mitigation measures.

Conclusion: Elevating Your Trading Game with BIAS

In conclusion, this indicator is a valuable ally for traders seeking to navigate the complexities of financial markets. By providing a clear snapshot of market sentiment, BIAS empowers traders to make well-informed decisions and enhance the overall effectiveness of their trading strategies. Whether you are a novice or seasoned trader, mastering the art of interpreting BIAS can contribute significantly to your success in the dynamic world of trading.

CalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight