Technical Indicator

Posted On: February 8, 2024

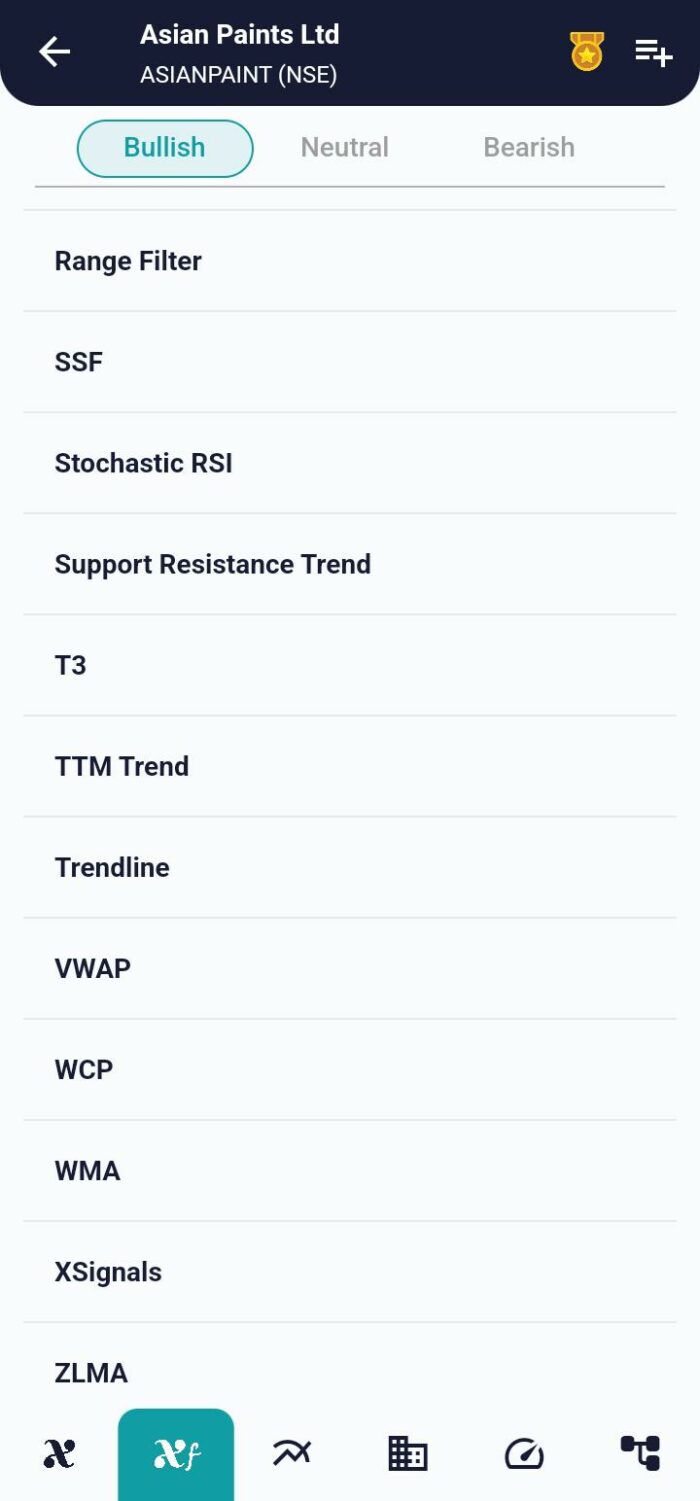

Unveiling Market Trends with Ehler’s Super Smoother Filter (SSF)

Introduction:

In the realm of technical analysis and signal processing, the quest for accurate and responsive filtering technical indicator led to the development of Ehler’s Super Smoother Filter (SSF). Crafted by John Ehlers, this digital filter stands apart for its prowess in reducing noise and providing smoother data compared to conventional moving averages. This article delves into the intricacies of SSF, shedding light on its functionality and the nuanced signals it generates, aiding traders in deciphering market trends.

Understanding Ehler’s Super Smoother Filter:

Super Smoother Filter (SSF)is designed to enhance the accuracy and responsiveness of filtering techniques, surpassing the capabilities of traditional methods. By minimizing noise in the data, SSF emerges as a valuable tool for technical analysts seeking a clearer picture of market trends.

SSF with SSF_pole == 3:

x = π / ssf_window

a0 = e^(-x)

b0 = 2 * a0 * cos(√3 * x)

c0 = a0^2

c4 = c0^2

c3 = -c0 * (1 + b0)

c2 = c0 + b0

c1 = 1 – c2 – c3 – c4

SSF[i] = c1 * data[‘AdjustedPrice’][i] + c2 * SSF[i – 1] + c3 * SSF[i – 2] + c4 * SSF[i – 3]

SSF with SSF_pole == 2:

x = π * √2 / ssf_window

a0 = e^(-x)

a1 = -a0^2

b1 = 2 * a0 * cos(x)

c1 = 1 – a1 – b1

SSF[i] = c1 * data[‘AdjustedPrice’][i] + b1 * SSF[i – 1] + a1 * SSF[i – 2]

In the formulas above, Super Smoother Filter (SSF)[i] represents the Super Smoother Filter value at index i, e^() represents the exponential function, cos() represents the cosine function, π is the mathematical constant pi, and √2 and √3 represent the square roots of 2 and 3, respectively. The SSF_pole parameter determines the number of poles in the SSF calculation, either 3 or 2. The SSF is recursively calculated based on the previous SSF values and the adjusted price data.

Key Conditions for Super Smoother Filter (SSF) Signals:

- Buy Signal Condition:

- Criteria:

- ‘SSF_Value’ is greater than the value in the ‘SSF_shift’ (previous value).

- ‘SSF_shift’ is less than the value in the ‘SSF_shift2’ (two periods prior).

- Interpretation:

- Indicates a potential “Buy” signal.

- Reflects that ‘SSF_Value’ is on the rise after being lower in the previous two periods.

- Criteria:

- Sell Signal Condition:

- Criteria:

- ‘SSF_Value’ is less than the value in the ‘SSF_shift’ (previous value).

- ‘SSF_shift’ is greater than the value in the ‘SSF_shift2’ (two periods prior).

- Interpretation:

- Represents a potential “Sell” signal.

- Highlights that ‘SSF_Value’ is falling after being higher in the previous two periods.

- Criteria:

- Hold Signal Condition:

- Criteria:

- Both buy and sell conditions are false.

- Interpretation:

- Indicates neither a buy nor a sell signal.

- Criteria:

Practical Application of SSF Signals:

- Market Trend Identification:

- Utilize Super Smoother Filter (SSF) signals to identify potential shifts in market trends.

- Enhance trend-following strategies by incorporating SSF buy and sell signals.

- Noise Reduction:

- Leverage SSF’s noise reduction capabilities to filter out market fluctuations.

- Achieve a smoother representation of data for more accurate analysis.

- Risk Management:

- Integrate Super Smoother Filter (SSF) signals into risk management strategies, adjusting positions based on buy, sell, or hold indications.

Conclusion:

Ehler’s Super Smoother Filter (SSF) emerges as a sophisticated tool in the arsenal of technical analysts, offering precise insights into market trends. The buy, sell, and hold signals generated by SSF empower traders to navigate the complexities of financial markets with a heightened level of confidence. Whether identifying potential buying opportunities, signaling sell-offs, or indicating periods of market stability, SSF proves invaluable for those seeking to make informed decisions in the ever-changing landscape of trading.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight