General

Posted On: February 16, 2024

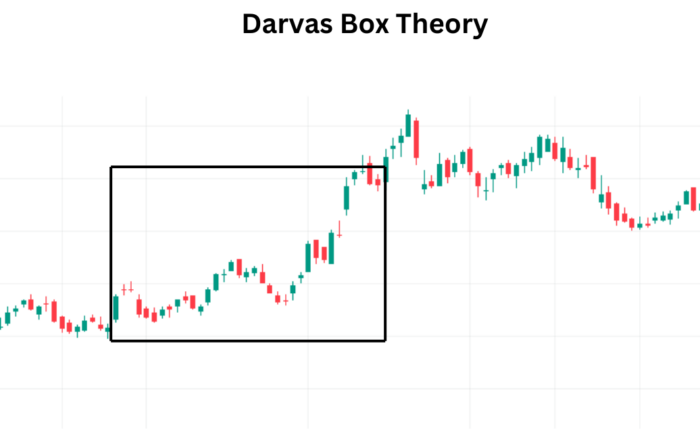

Unveiling the Darvas Box Theory: A Momentum-Based Trading Strategy

Introduction:

The Darvas Box Theory, crafted by self-taught investor Nicolas Darvas in the 1950s, stands as a compelling trading strategy rooted in the principles of technical analysis. This approach, closely tied to momentum theory, revolves around identifying stocks at new price highs, creating distinct entry and exit points using boxes drawn around recent price movements. Let’s delve into the intricacies of the Darvas Box Theory and explore its application in today’s dynamic market landscape.

Understanding the Darvas Box Theory:

Application of the Theory: The Darvas Box Theory is a momentum-driven strategy that identifies stocks likely to continue their previous price trends. By drawing boxes around recent price highs and lows, practitioners establish entry and exit points, with stop-loss orders acting as a safeguard. Long positions are favored in rising boxes, utilizing box highs as exit points. This strategy hinges on the belief that past price increases signal future growth, emphasizing the importance of momentum in stock movements.

Combination of Technical and Fundamental Analysis: Although perceived as a technical trading strategy, Darvas did incorporate fundamental analysis into his stock selection process. Beyond pricing and volume, he considered qualitative and quantitative factors, targeting sectors with high excitement potential and companies displaying revolutionary products. Fundamental analysis aided in identifying stocks with sustained earnings growth, complementing the purely technical aspects of the strategy.

Insights from the Darvas Box Theory:

1. Focus on Growth Industries: Darvas emphasized targeting sectors and industries with high excitement potential and revolutionary products. This insight encourages investors to stay attuned to evolving industries, identifying opportunities for growth and innovation.

2. Investing in High-Volume Securities: The Darvas Box Theory places importance on high-volume securities, interpreting strong moves in stock prices. While the landscape has evolved with algorithmic trading, understanding and leveraging volume trends remain crucial for informed investment decisions.

3. Use of Stop-Loss Orders: Darvas’s approach incorporates the use of stop-loss orders to minimize losses and secure gains. This risk management tool remains relevant, offering a safety net against adverse price movements and providing a structured exit strategy.

Conclusion:

While the Darvas Box Theory might not be as effective in today’s highly efficient and information-rich market, its core principles offer valuable insights. Balancing momentum-based strategies with a blend of technical and fundamental analysis can enhance decision-making, providing a comprehensive approach for investors navigating the complexities of the contemporary financial landscape.

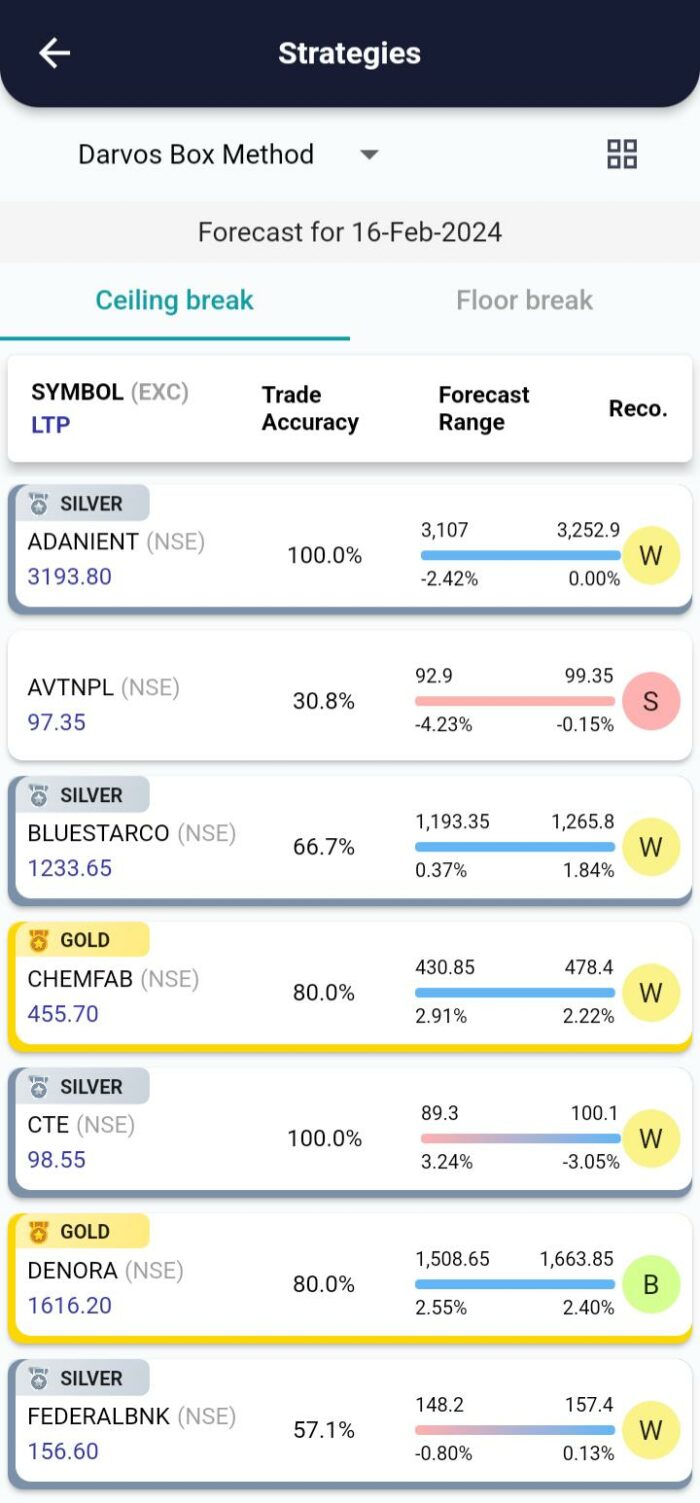

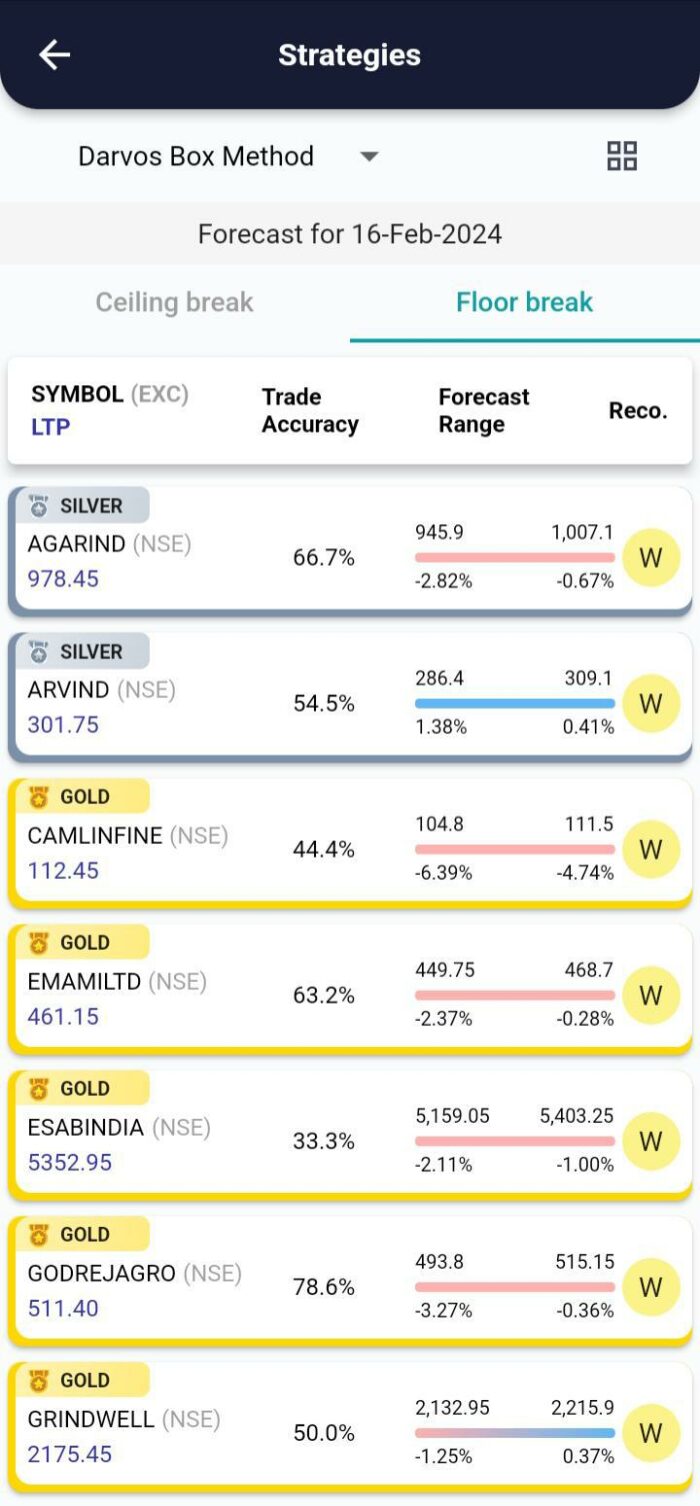

Where can I see further insights on this stock?

xCalData offers unbiased insights into stocks. Download the app from google play. For Actionable Intelligence, subscribe to xCalData app on Android devices: Download here

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Disclaimer: The securities quoted are for illustration only and are not recommendatory.

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight