Posted On: August 22, 2023

Unveiling the Gravestone Doji Candlestick Pattern in Financial Trading

A Comprehensive Manual for Traders:

Within the realm of technical analysis, candlestick patterns serve as indispensable tools for traders seeking valuable insights into market sentiment and potential reversals. The Gravestone Doji is one such pattern, holding immense significance for traders due to its ability to offer essential clues about market directions. In this blog post, we will delve into the concept of the Gravestone Doji pattern, explore its distinctive identifying characteristics, and discuss how traders can adeptly interpret this pattern to make informed trading decisions.

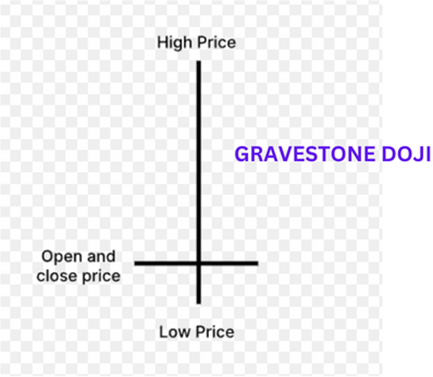

The Gravestone Doji emerges as a solitary candlestick pattern, often appearing during both uptrends and downtrends. It stands as an indicator of market indecision and hints at potential trend reversals. This pattern showcases a candlestick with an elongated upper shadow, while the lower shadow is either negligible or entirely absent. Additionally, the closing price of the candlestick is closely aligned with its low for the trading session.

Characteristics of Gravestone Doji:

To effectively identify the Gravestone Doji pattern, traders should keep a keen eye on the following key features:

- Uptrend or Downtrend: This pattern can manifest within both uptrends and downtrends, signifying potential reversals in either scenario.

- Elongated Upper Shadow: The candlestick sports a prominent upper shadow, indicating that prices witnessed an initial rise during the session but ultimately retreated to close near the opening level.

- Minimal or No Lower Shadow: The candlestick exhibits a negligible or entirely absent lower shadow, symbolizing minimal buying pressure throughout the trading session.

- Close Proximity to Low: The candlestick’s closing price is in close alignment with its low for the day, reinforcing a prevailing bearish sentiment.

Interpreting Gravestone Doji:

The Gravestone Doji pattern strongly implies market indecision and a potential shift in sentiment. It materializes when buyers initially drive prices higher, only to lose control later, resulting in prices falling back to near the opening level. Consequently, traders interpret this pattern as a cautious signal, prompting them to seek further validation before making any decisive trading moves.

Confirmation and Trading Strategies:

While the Gravestone Doji pattern imparts critical insights, prudent traders often seek supplementary confirmation prior to executing trades. Consideration of the following factors can bolster trading decisions:

- Volume Confirmation: Enhanced trading volume during pattern formation fortifies the potential trend reversal’s credibility.

- Support and Resistance Levels: Identifying key support and resistance levels can reinforce pattern authenticity and assist in setting achievable price targets.

- Technical Indicators: Merging the Gravestone Doji pattern with other technical indicators, like moving averages or oscillators, enriches the trading decision-making process.

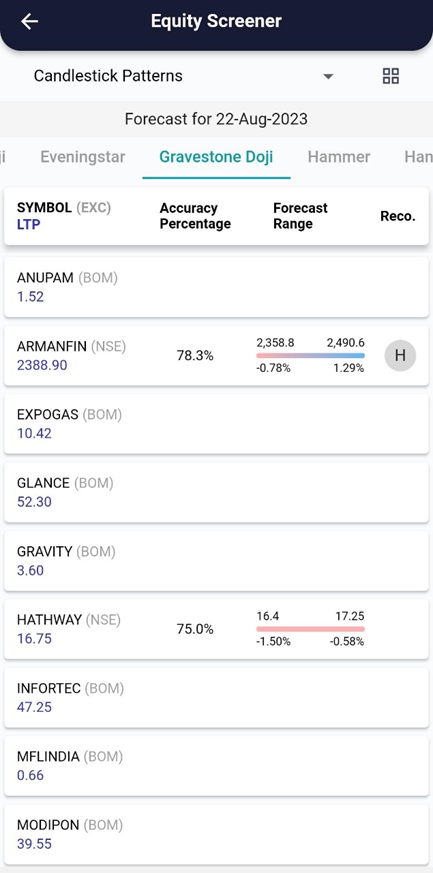

xCalData analyses the candles of individual stocks daily and identifies the stocks forming various patterns. Checkout xCalData app to know all the candle stick patterns formed by the stock of your interest.

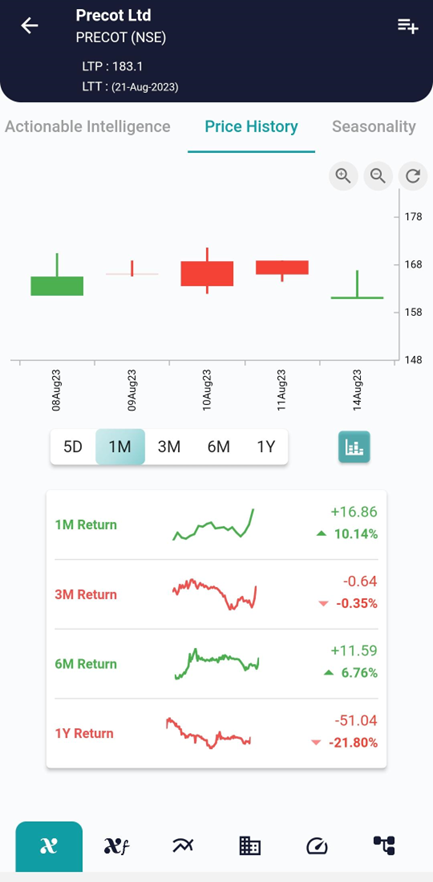

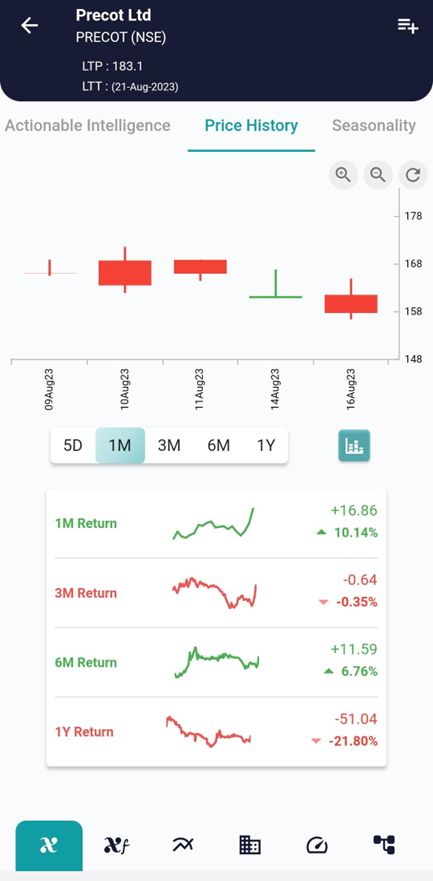

Example, on 14 Aug the stock showed the Gravestone Doji pattern and on 16 Aug the stock started going down as can be seen in the interpretation above.

Conclusion:

The Gravestone Doji pattern stands as an invaluable instrument for traders, granting insights into market indecision and potential trend reversals. Astutely understanding its unique identifying characteristics and skilfully interpreting this pattern empowers traders to refine their trading strategies.

Nevertheless, it remains essential to recognize that no pattern guarantees success, and informed trading decisions necessitate additional verification and comprehensive analysis.

Trading always involves risk, and it is crucial to develop a well-rounded trading strategy, including risk management techniques, to increase your productivity and achieve long-term success in the financial markets, Visit and download xCalData.

Where can I see further insights on this stock?

xCalData offers unbiased insights into stocks. Download the app from google play. For Actionable Intelligence, subscribe to xCalData app on Android devices: Download here

Disclaimer: The securities quoted are for illustration only and are not recommendatory.