Candlestick Pattern

Posted On: August 9, 2023

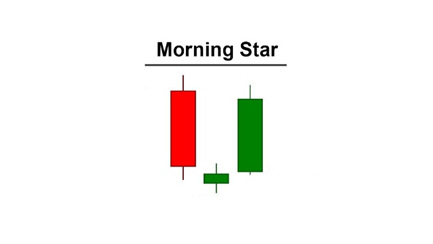

Unveiling the Morning Star Candlestick Pattern

A Comprehensive Guide for Traders:

Candlestick patterns hold immense value in technical analysis, helping traders spot potential trend reversals and gauge market sentiment. Among these patterns, the Morning Star stands out as a key signal for traders seeking bullish opportunities. This blog post will explore the defining characteristics of the Morning Star candlestick pattern, provide insights into its identification and interpretation, and examine its implications for effective trading strategies. The Morning Star is a three-candlestick pattern that emerges at the end of a downtrend, indicating a possible shift from bearish to bullish sentiment. This pattern comprises a strong bearish candlestick, followed by a small-bodied candlestick, and concludes with a large bullish candlestick.

Characteristics of Morning Star:

To successfully identify the Morning Star pattern, traders should pay attention to these essential features:

- Initial Bearish Candlestick: The pattern initiates with a robust bearish candlestick, signaling an existing downtrend in the market.

- Small-bodied Middle Candlestick: The second candlestick is typically characterized by a doji, spinning top, or a candle with a small body and limited price range, reflecting indecision and a potential weakening of the preceding bearish trend.

- Large Bullish Candlestick: The Morning Star pattern concludes with a substantial bullish candlestick, featuring a close significantly higher than the previous candle’s close. This implies a possible transition to bullish sentiment.

Interpreting the Morning Star:

The Morning Star pattern serves as a strong signal for traders to consider a trend reversal from bearish to bullish. It suggests potential buying opportunities or long positions in the market. Additionally, the pattern hints at favorable conditions for traders to benefit from upward price movements.

Confirmation and Trading Strategies:

While the Morning Star pattern provides a compelling bullish signal, traders often seek further confirmation before executing trades. Important factors to consider include:

- Volume Confirmation: Heightened trading volume accompanying the formation of the Morning Star strengthens the reliability of the bullish sentiment.

- Support and Resistance Levels: Identifying significant support and resistance levels reinforces the pattern’s importance and assists in setting appropriate price targets.

- Additional Technical Indicators: Combining the Morning Star pattern with other technical indicators, such as moving averages, trendlines, or oscillators, can provide supplementary confirmation and enhance trading decisions.

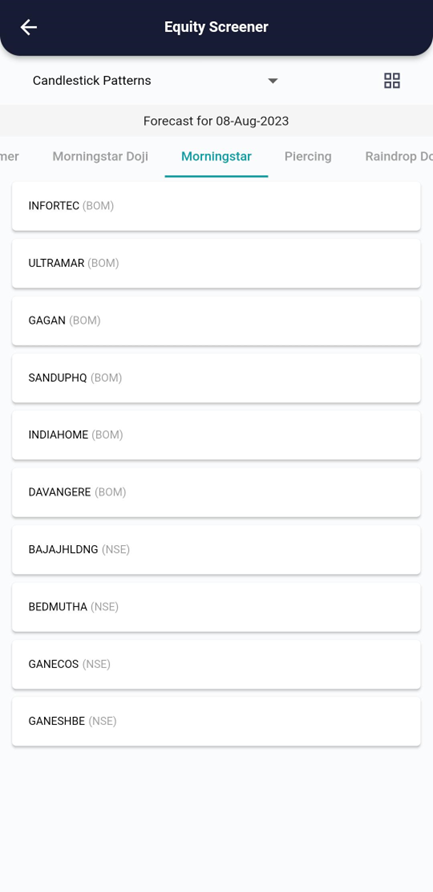

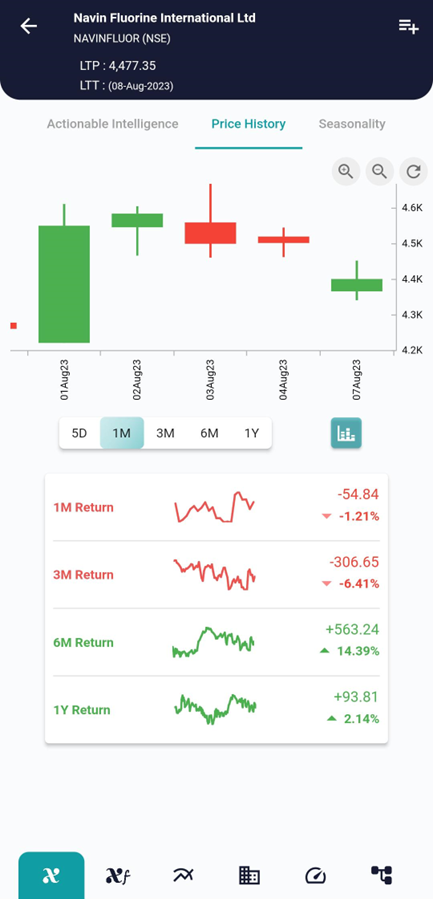

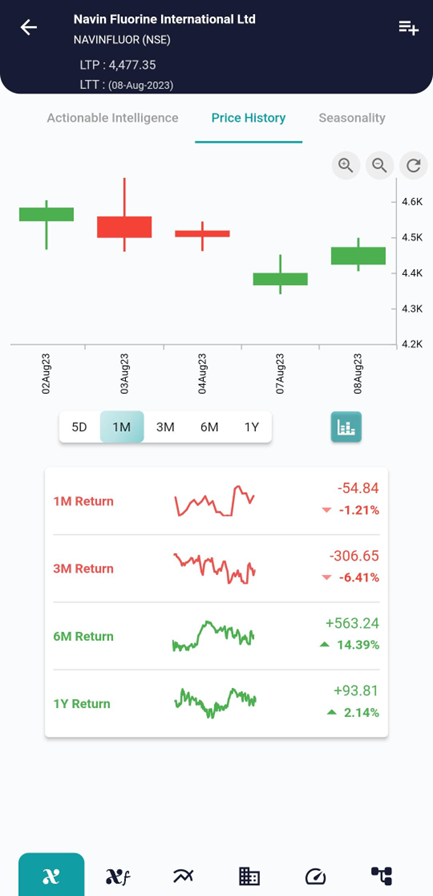

xCalData analyses the candles of individual stocks daily and identifies the stocks forming various patterns. Checkout xCalData app to know all the candle stick patterns formed by the stock of your interest.

Example, on 07 Aug the stock showed the Evening Star and on 08 Aug the stock started going up as can be seen in the charts above.

Conclusion:

The Morning Star candlestick pattern serves as a valuable tool for traders, providing insights into potential trend reversals and shifts in market sentiment. By understanding its characteristics and effectively identifying this pattern, traders can optimize their trading strategies.

However, it is essential to remember that patterns do not guarantee success, and additional confirmation and comprehensive analysis are essential for making informed trading decisions.

Trading always involves risk, and it is crucial to develop a well-rounded trading strategy, including risk management techniques, to increase your productivity and achieve long-term success in the financial markets, Visit and download xCalData.

Where can I see further insights on this stock?

xCalData offers unbiased insights into stocks. Download the app from google play. For Actionable Intelligence, subscribe to xCalData app on Android devices: Download here

Disclaimer: The securities quoted are for illustration only and are not recommendatory.

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight