Technical Indicator

Posted On: January 31, 2024

Unveiling the Power of the Center of Gravity Indicator

The Intricacies of the Center of Gravity Indicator

The Center of Gravity (COG) technical indicator, also known as COG, is a valuable tool embraced by both seasoned professionals and novice traders. Introduced in 2002, its primary goal is to swiftly identify potential support and resistance levels, offering traders ample time to strategize their trades effectively.

The COG indicator is particularly popular for navigating range-bound markets and finds utility among position traders, intraday traders, and scalpers. While it shines in various trading scenarios, it is notably advantageous for Forex trading. Unlike many technical indicators that reflect ongoing market conditions, the COG indicator stands out by predicting future market movements, adding a proactive dimension to trading strategies. However, it’s crucial to recognize its limitations, which we’ll delve into later in this article.

Unveiling the Theory Behind COG

At its core, the COG indicator operates on the theory that prices exhibit cyclical patterns, manifesting as highs and lows on the chart. According to this theory, prices tend to regress toward the mean, represented by the blue line at the center of the indicator.

Technical indicators are generally classified as leading or lagging. COG falls into the category of leading indicators, making it ideal for trading range-bound markets. While lagging indicators confirm trends by analyzing historical market data, leading indicators like COG forecast future directions.

Choosing the Right Markets for COG

COG-based trading strategies hinge on the assumption that prices cyclically orbit around the mean. However, not all asset classes exhibit the same inherent cyclical nature. For instance, Forex trading, backed by countries, governments, and central banks, often displays more cyclical price action compared to the stock or cryptocurrency markets.

Stocks and cryptocurrencies, lacking the same institutional backing, can witness limitless increases or plummet to zero. Consequently, the COG indicator is less actively applied in these markets.

COG-Based Trading Strategies

1. Scalping with COG

- Scalpers, operating in lower time frames, leverage COG for identifying turning points swiftly.

- Entry points involve selling when the price breaches the upper band and buying when it falls below the lower band.

- Exit points and stop-loss targets are less rigid, relying more on real-time price action.

2. Belkhayete’s Center of Gravity Trading Strategy

- Introduced by El Mostafa Belkhayate, this strategy won acclaim in France and earned accolades at the Paris trading fair.

- It utilizes a 4-hour chart for entries, aligning positions with the prevailing trend indicated by the blue gravity line.

- Trades are initiated when the first candle closes within the upper or lower bands’ range, anticipating pullbacks and COG signals.

Limitations of the Center of Gravity Indicator

1. Market Conditions Suitability

- COG is most effective in range-bound markets, and determining the right conditions for its application is a challenge.

2. Technical-Only Approach

- As a purely technical tool, COG overlooks crucial factors like fundamentals. Its effectiveness is enhanced when combined with other analytical instruments.

3. Time Frame Sensitivity

- COG’s efficacy diminishes on smaller time frames, leading to more false signals. Scalpers mitigate this by trading more frequently and managing smaller risks per trade.

4. Dynamic Nature

- COG’s dynamic nature makes backtesting challenging as the indicator lines shift with evolving prices.

5. Reversal Trading Complexity

- Trading reversals with COG can be intricate, especially for novice traders. It’s often safer to follow trends than attempt to predict tops and bottoms.

In Conclusion

In summary, the COG indicator is a potent tool for generating entry signals in range-bound markets. Its precision increases with higher time frames, albeit at the cost of reduced signal frequency. Positioned as a leading indicator, COG provides a glimpse into future price movements. While it presents certain limitations, strategic application within a broader context enhances its effectiveness. Traders should be mindful of these nuances, continually refining their strategies to navigate diverse market conditions and ensure consistent results.

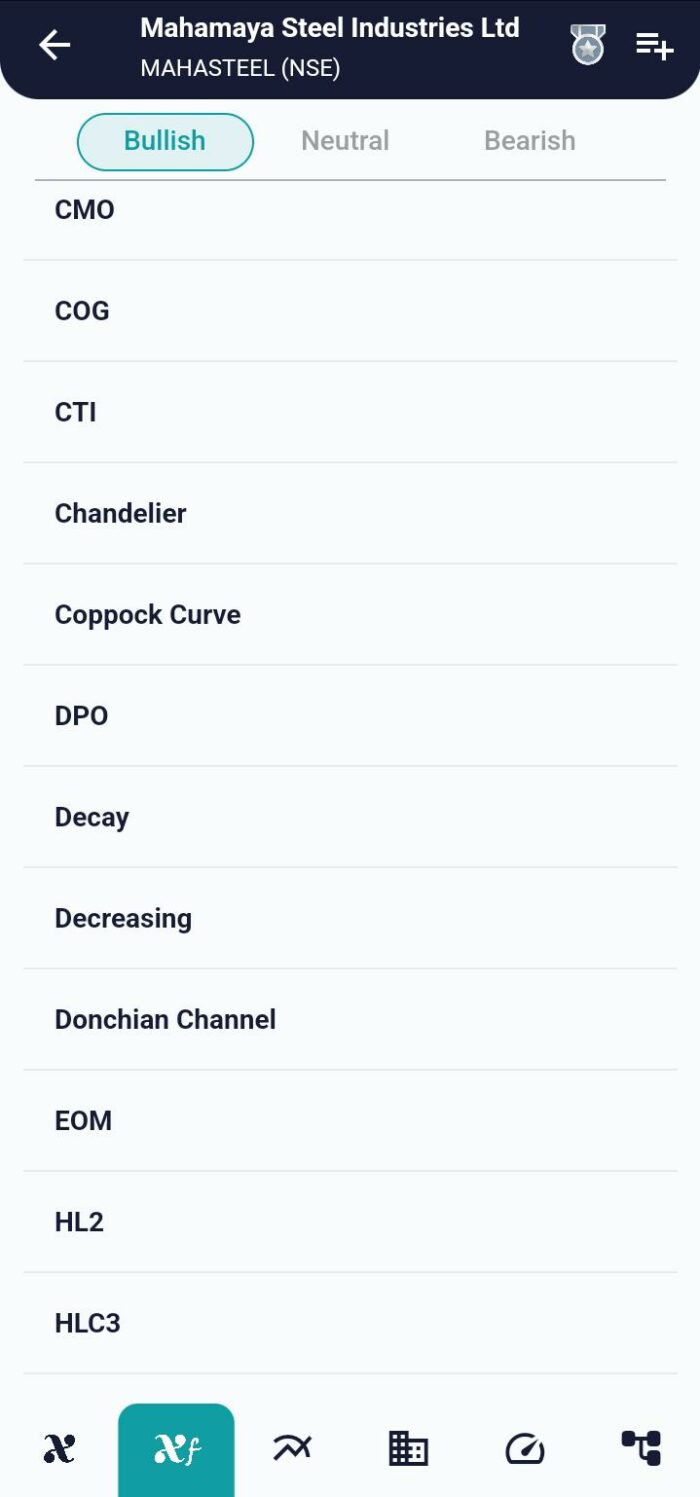

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight