Strategy

Posted On: January 19, 2024

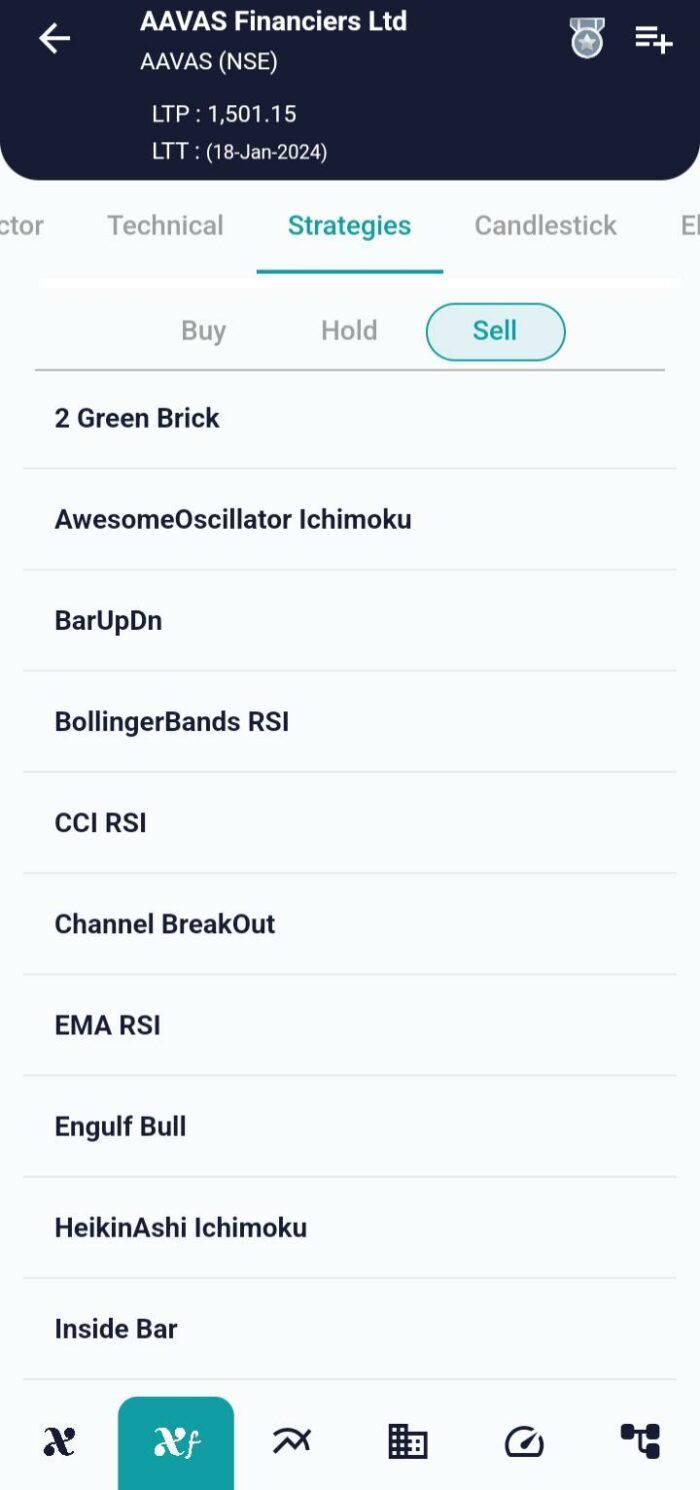

Unveiling the Two Green Brick Strategy: Navigating Markets with Candlestick Precision

In the dynamic world of trading, strategies based on candlestick patterns often stand out for their ability to capture nuances in price movements. The Two Green Brick strategy, , is one such approach that relies on Strategy to make informed trading decisions. In this blog post, we will explore the intricacies of the strategy, including its operational principles using XCaldata app

Introduction to the Two Green Brick Strategy

The “Two Green Brick” strategy is grounded in the observation of specific candlestick patterns to guide trading decisions. Traders employing this strategy need to be mindful of the inherent risks associated with any trading approach, and careful consideration of market conditions is paramount. Despite its potential risks, the strategy is recognized for its effectiveness when applied judiciously.

Dataset Utilized in the Strategy

To execute the “Two Green Brick” strategy successfully, traders rely on three key datasets:

- Technical Data: This dataset encompasses various technical indicators that contribute to the strategy’s decision-making process. Technical analysis plays a crucial role in identifying trends and potential entry or exit points.

- Price Data: Price data is fundamental to the strategy, providing information on the opening, closing, high, and low prices for each trading session. This data is essential for recognizing candlestick patterns, a cornerstone of the strategy.

- Calendar Data: Calendar data involves information about the timing of trading sessions, market events, and economic releases. Understanding the broader market context aids traders in making well-informed decisions.

Key Parameters of the Strategy

- Previous Price Data: The strategy requires access to the previous three days’ price data for a single business day. This historical perspective is crucial for identifying patterns and trends.

- Previous Strategy Outputs: To enhance decision-making, the strategy relies on the historical outputs from previous executions. This information guides interpretation conditions, ensuring that a buy signal is validated before considering a sell.

Interpretations Guiding Buy and Sell Decisions

BUY:

- If today’s candle is GREEN, and yesterday’s candle was also GREEN, the strategy generates a buy signal. This condition indicates a potential bullish trend.

SELL:

- If today’s candle is RED, and yesterday’s candle was also RED, the strategy generates a sell signal. This condition suggests a potential bearish trend.

Conclusion: Navigating Markets with Precision

In conclusion, the “Two Green Brick” strategy offers traders a systematic approach to navigate the markets by leveraging candlestick patterns. By incorporating technical, price, and calendar data, along with key parameters and interpretations, traders can make informed buy and sell decisions. It is crucial for traders to exercise caution, continuously monitor market conditions, and adapt their strategies to changing dynamics. As the “Two Green Brick” strategy becomes an integral part of a trader’s toolkit, it opens doors to potential opportunities and enhances precision in the ever-evolving landscape of financial markets.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight