General

Posted On: October 16, 2023

XCalData: Your Ultimate Source for Comprehensive Firmographics in Trading

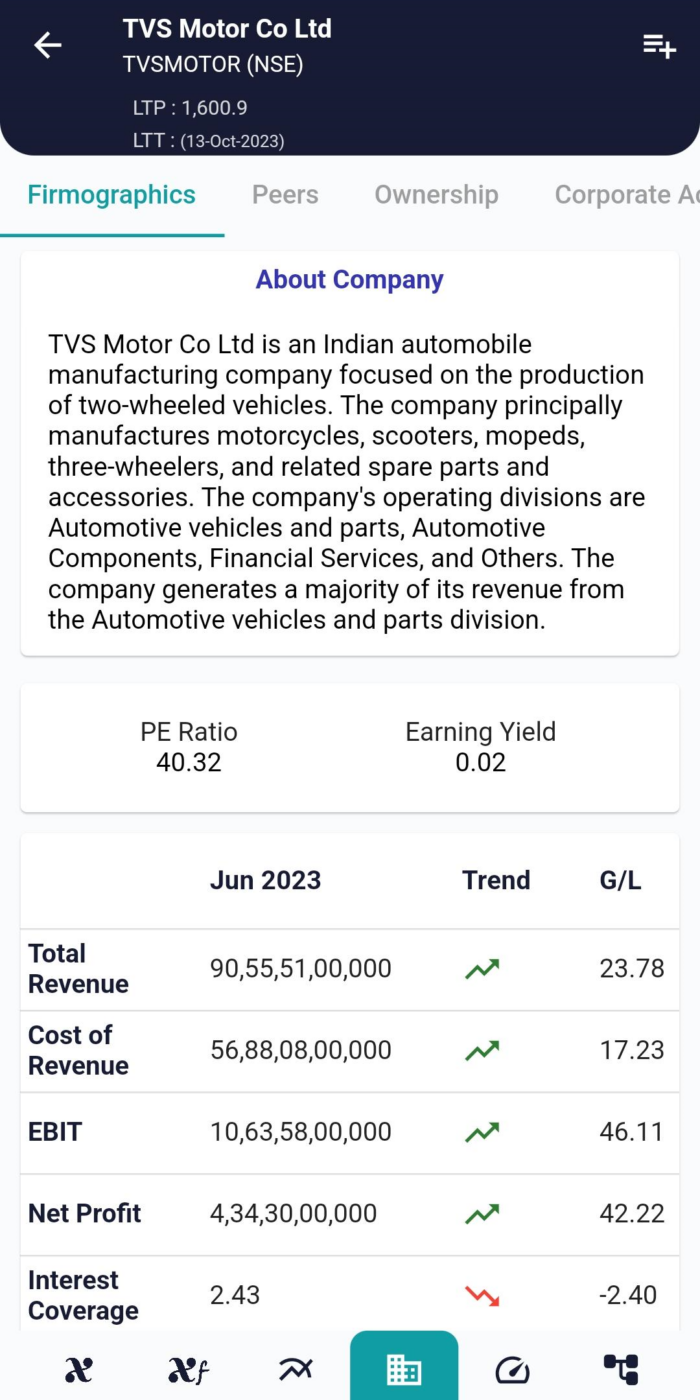

In the fast-paced world of trading, access to accurate and up-to-date information is paramount. Making informed decisions depends on having the right data at your fingertips. When it comes to understanding the financial health and characteristics of the companies you’re trading, XCalData emerges as your ultimate source for comprehensive firmographics. Whether you’re a novice trader or a seasoned investor, Xcaldata’s extensive database offers a wealth of information, including total revenue, cost of revenue, EBIT (Earnings Before Interest and Taxes), Net Profit, Interest Coverage, PE Ratio (Price-to-Earnings Ratio), and Earning Yield.

Here’s why XCalData should be your go-to platform for firmographic data:

XCalData delivers vital firmographics, including total revenue, cost of revenue, EBIT, Net Profit, Interest Coverage, PE Ratio, and Earning Yield. With real-time access to this data, traders gain a competitive edge, enabling informed decisions and strategic market insights. Stay ahead in the dynamic trading landscape with XCalData comprehensive firmographics.

1. Total Revenue: Total revenue is a key indicator of a company’s financial performance. It reflects the money generated from its core operations. XCalData provides accurate, real-time data on total revenue for a wide range of publicly traded companies.

2. Cost of Revenue: Understanding a company’s cost of revenue is crucial for assessing its profitability. Xcaldata offers insights into how efficiently a company manages its expenses related to producing goods or services.

3. EBIT (Earnings Before Interest and Taxes): EBIT is a measure of a company’s operating profitability, excluding interest and taxes. Xcaldata’s platform allows you to access EBIT data, which can provide a clear picture of a company’s core financial performance.

4. Net Profit: Net profit is the bottom line of a company’s income statement, representing its earnings after all expenses have been deducted. Xcaldata offers real-time information on net profit, allowing you to gauge a company’s overall financial health.

5. Interest Coverage: Interest coverage is a critical metric for evaluating a company’s ability to meet its debt obligations. Xcaldata provides data on interest coverage ratios, helping you assess a company’s financial risk.

6. PE Ratio (Price-to-Earnings Ratio): The PE ratio is a widely used valuation metric in trading. It compares a company’s stock price to its earnings per share (EPS). Xcaldata’s platform offers PE ratio data, enabling you to make informed decisions about the relative value of a stock.

7. Earning Yield: Earning yield is the reciprocal of the PE ratio and can be a valuable indicator of a stock’s potential return. Xcaldata’s platform provides earning yield data, allowing you to assess the attractiveness of a stock in your trading portfolio.

By utilizing Xcaldata’s comprehensive platform, you can gather, analyze, and incorporate firmographics data into your trading strategies with confidence. Real-time access to these key metrics empowers you to make informed trading decisions and seize opportunities as they arise in the dynamic world of financial markets.

Whether you’re a day trader, swing trader, or long-term investor, the accuracy and breadth of firmographics data available through XCalData will be your competitive edge in staying ahead of the market and making profitable trading decisions. Embrace XCalData as your trusted source for the firmographic insights that matter most in your trading journey.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight